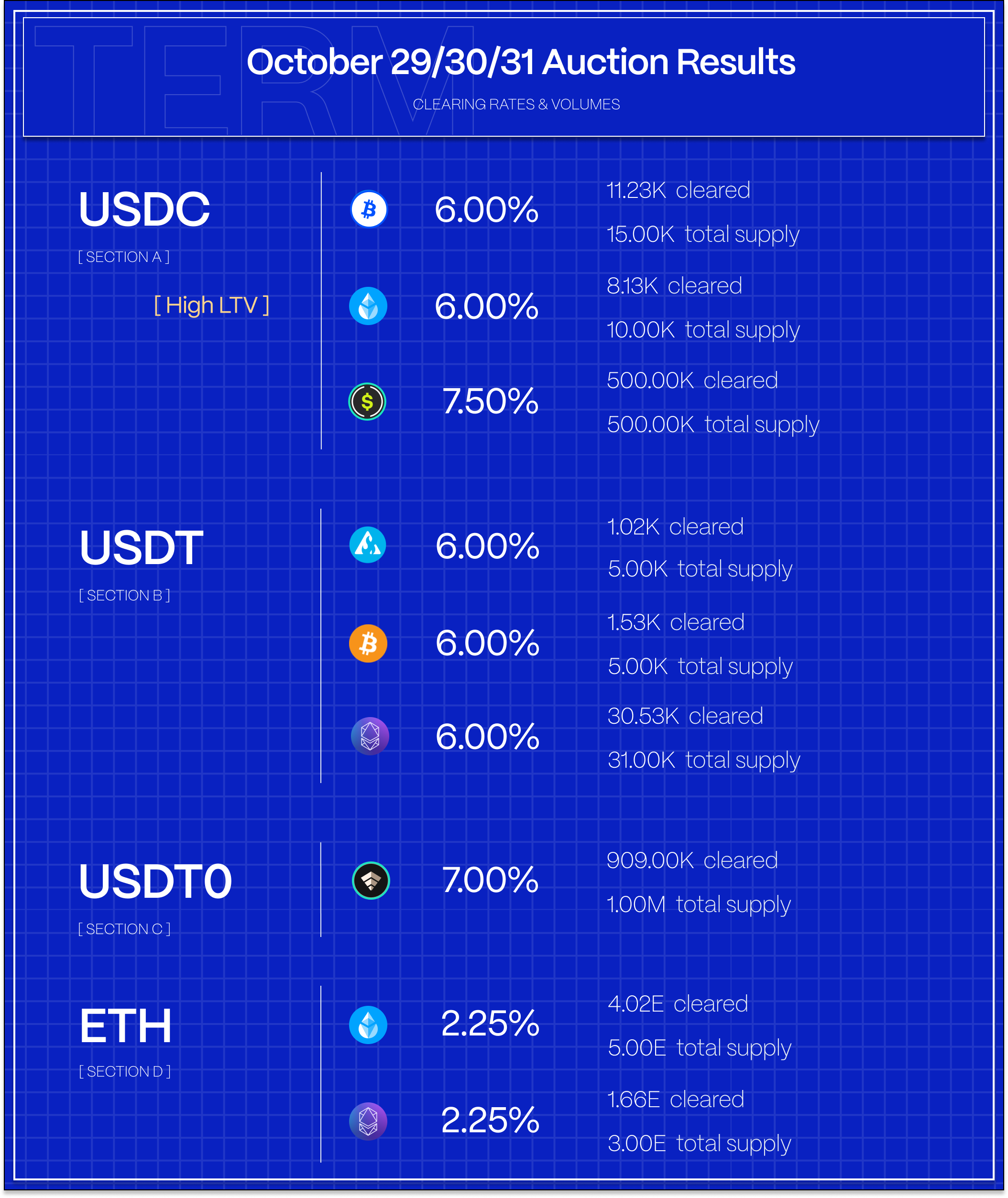

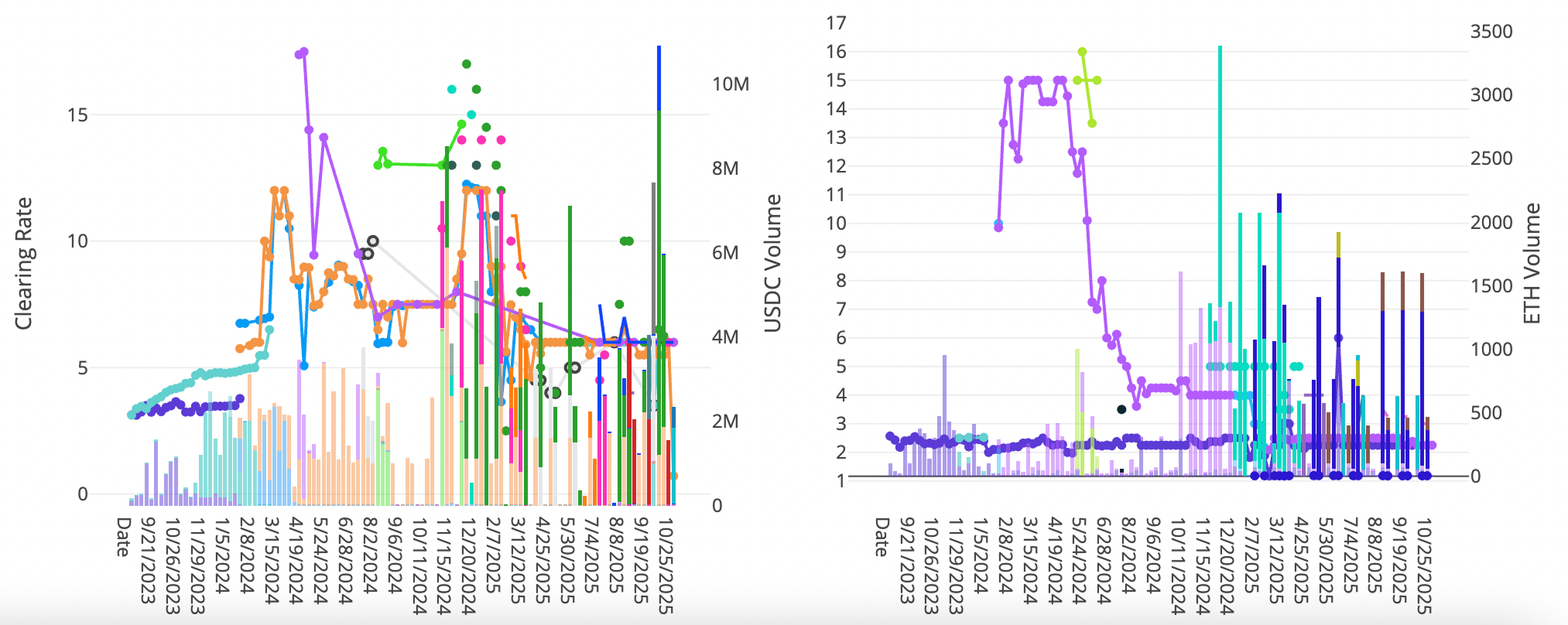

Markets were on the quieter side this week. On Term, just shy of $2M in stablecoin loans cleared with just a handful on ETH clearing on the ETH side. Cap Protocol PTs and USDai PTs made their debut on Term as users reach for yield in an otherwise yield starved environment.

For those eager to lock in fixed rates and hedge against further declines in lending rates, visit our Blue Sheets Simple Earn page to explore current opportunities (Not available to U.S. persons).

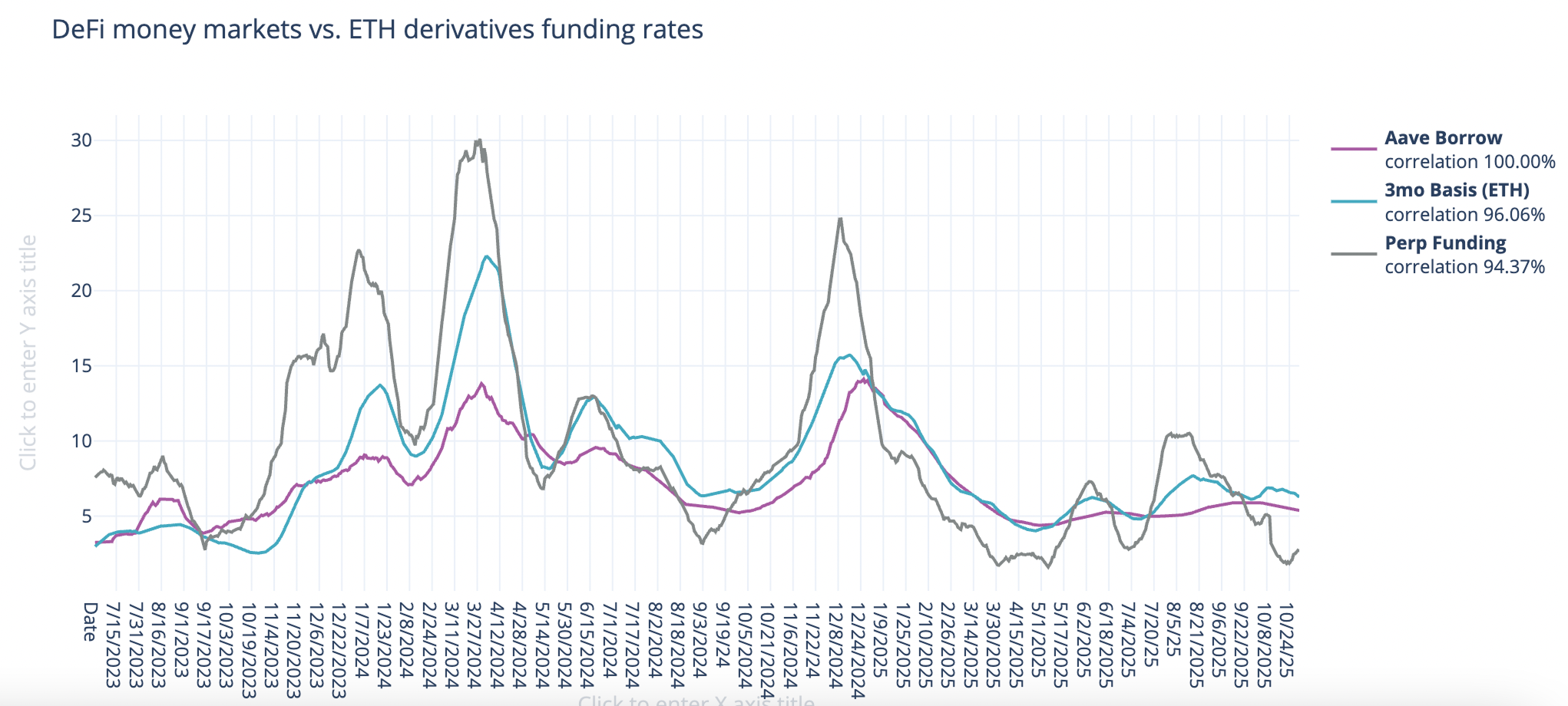

Basis and Perpetuals Markets

In derivatives markets, funding rates were mixed, with 3-month basis falling -30bps to 5.19% while perpetual funding rates bounced back by +82bps to 3.87% on a 30-day trailing basis. The move was helped by a pre-Fed rally that quickly faded as Powell sounded hawkish during his post-meeting conference.

The relief rally in the first half of the week, however, did help to normalize the spread between DeFi / derivatives funding rates.

Overall, the market tone remains sluggish with BTC trading rangebound and despite a Fed cut and news of a negotiated “truce” in the US-China trade war. Hopefully muted volatility as we go into the holidays will help lift markets into year end.

USDC Markets

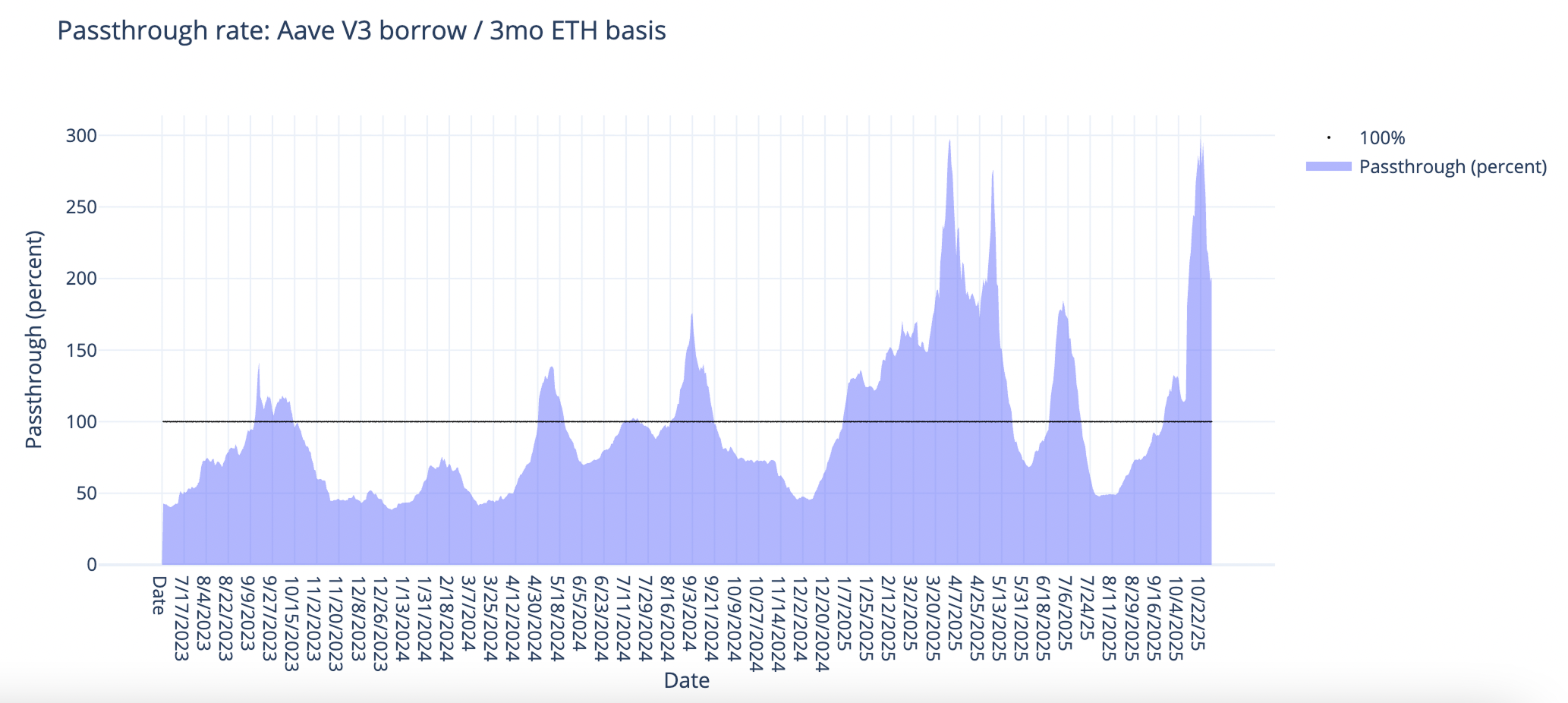

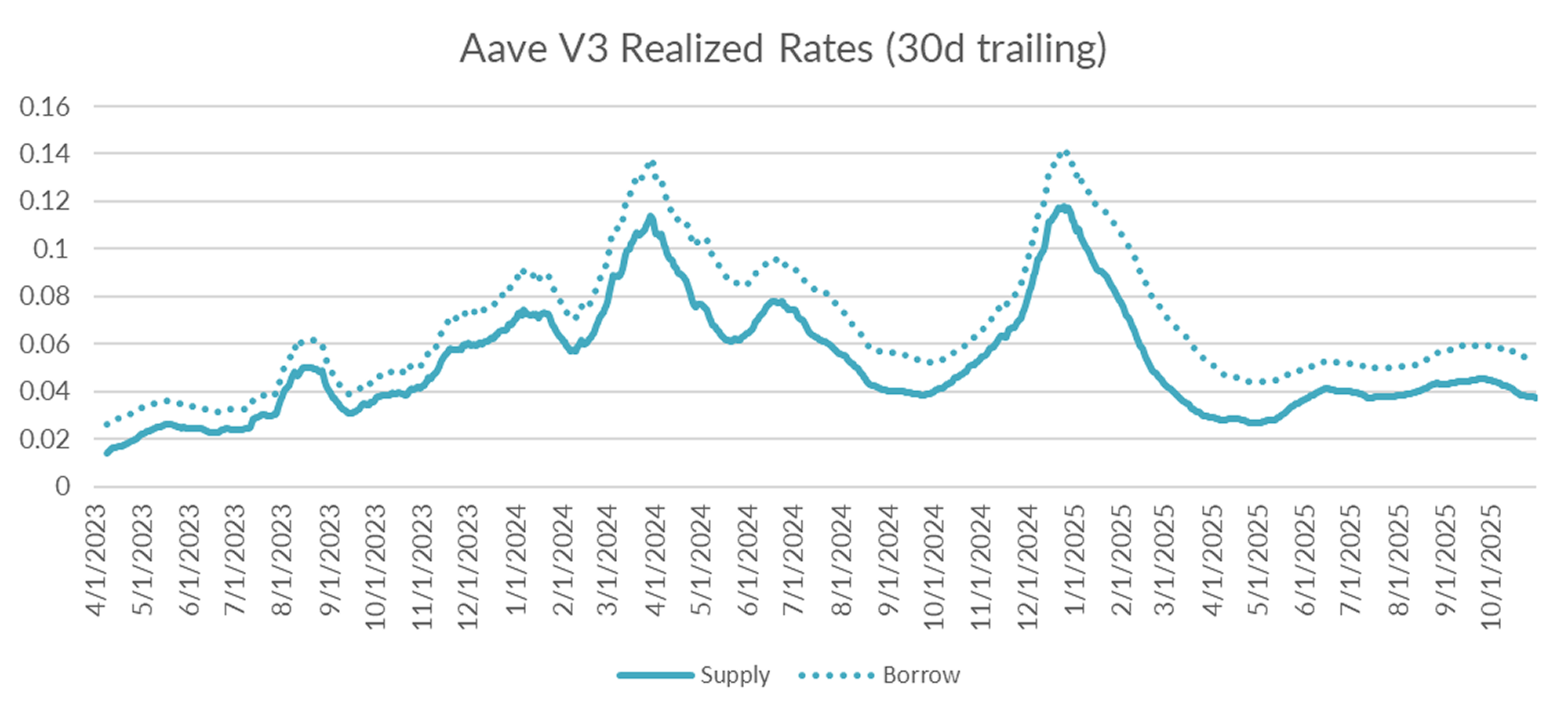

Turning to DeFi variable rate markets, the 30-day trailing average continued to fall, declining by -10bps to 5.38% on a 30-day trailing basis. On a shorter lookback period, USDC borrow rates averaged 5.12% suggesting further declines ahead.

Diving into the microstructure of Aave's USDC markets, internal metrics are relatively steady with utilization closing relatively unchanged at 75%.

In line with stable utilization rates, borrow/lend spreads hold steady near the long term historical average of ~165bps.

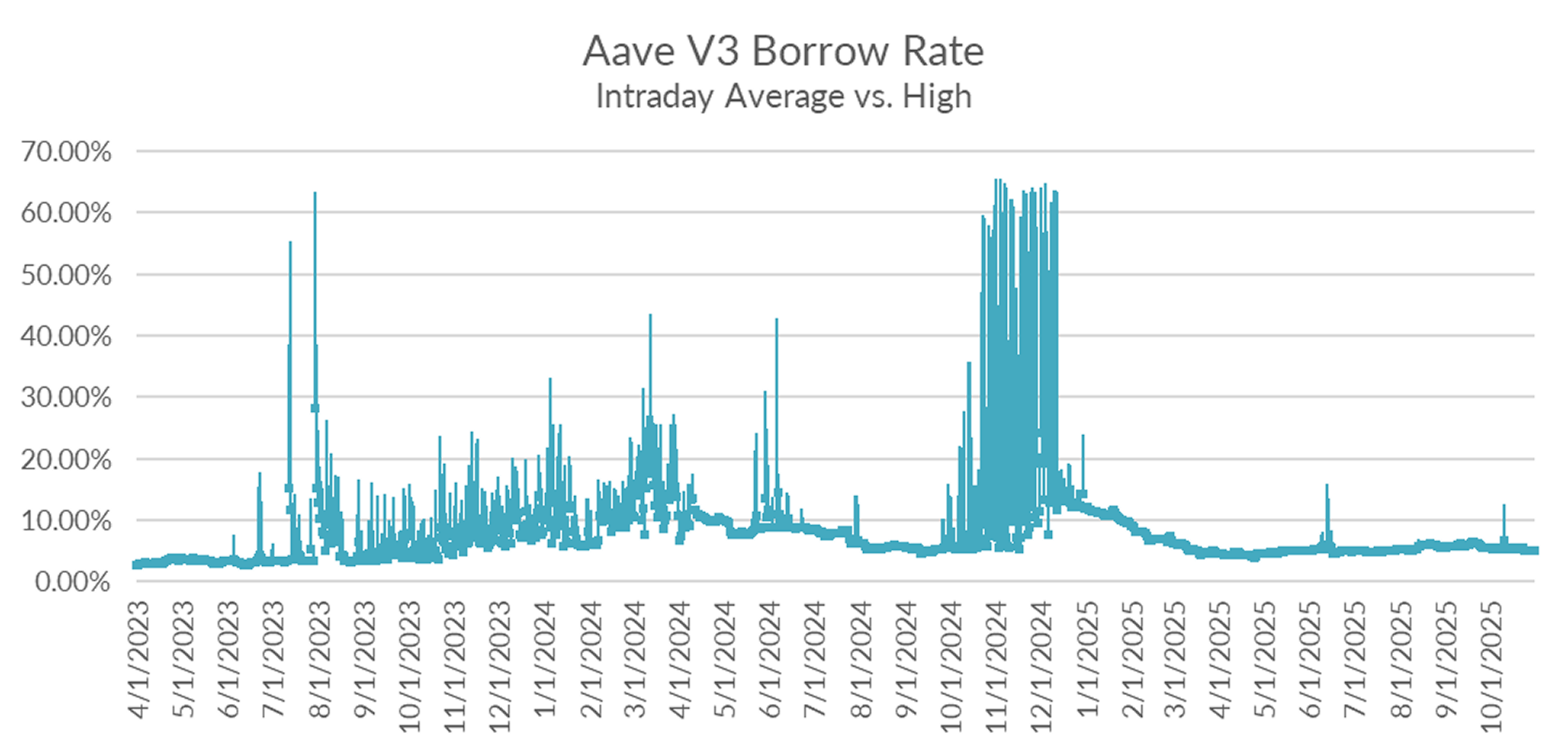

A glimpse into intraday rate dynamics show no signs of intraday stress evidencing well supplied markets.

Trump and Xi’s meeting came and went with relatively little market reaction. The lack of follow-through is keeping a cap on demand for leverage despite declining market volatility.

ETH Markets

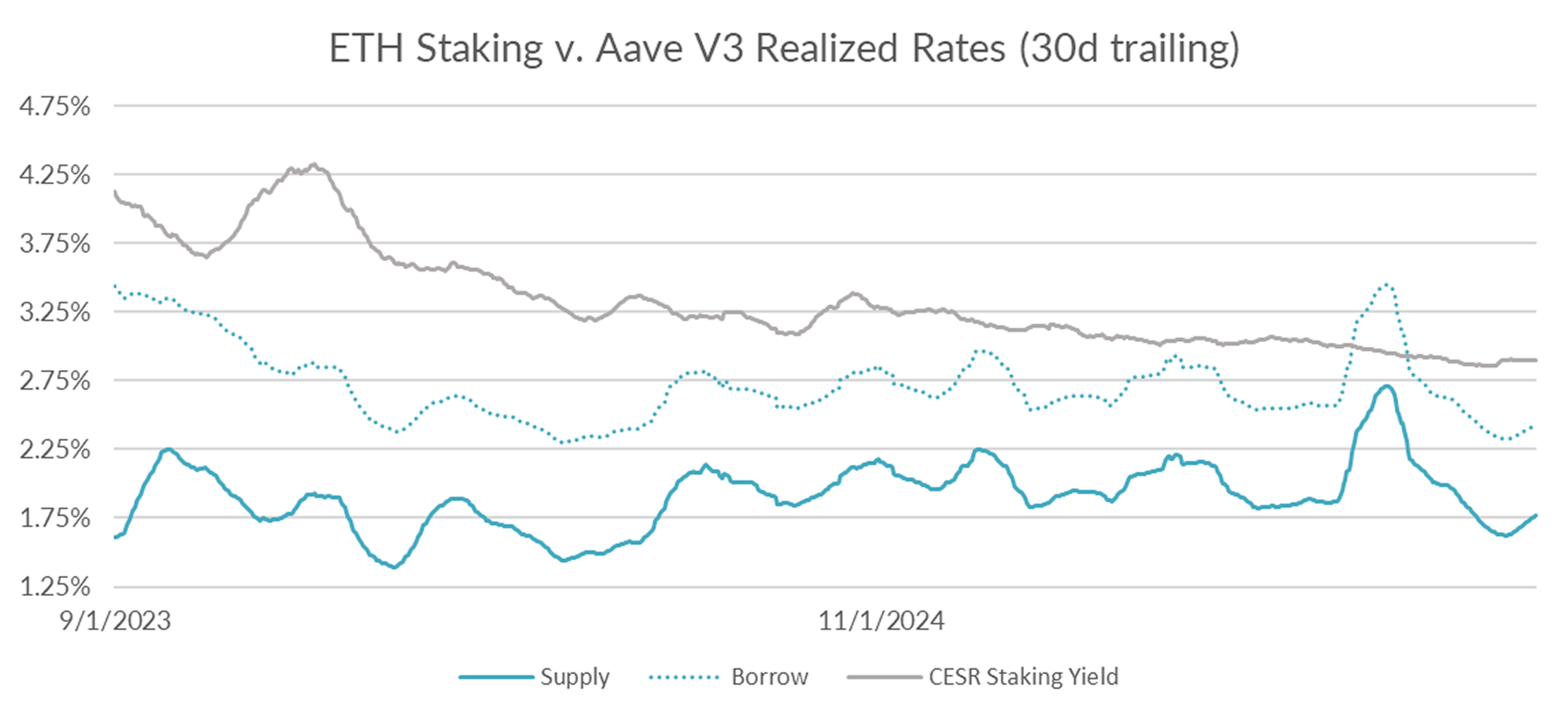

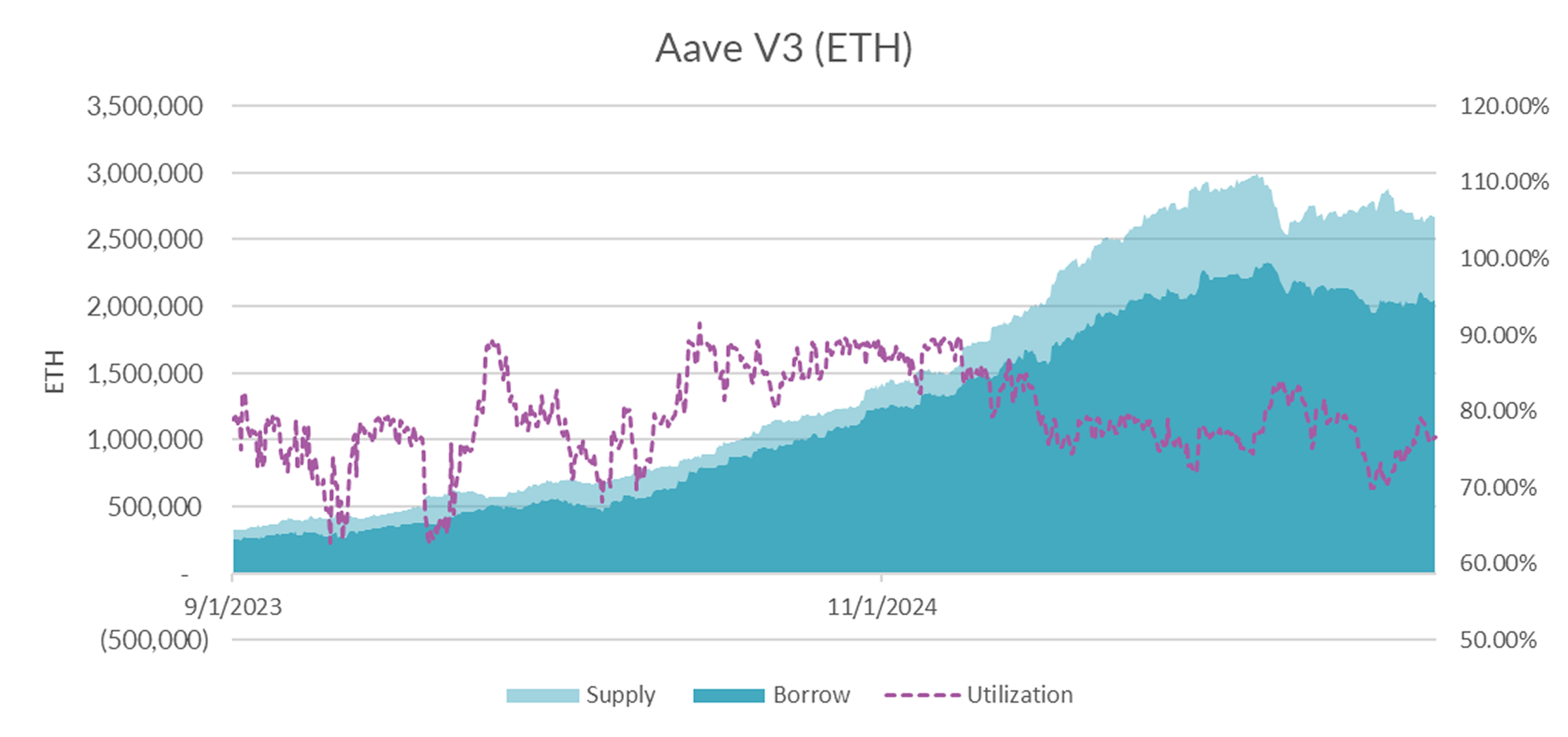

Turning now to ETH markets, ETH rates rose +4bps to 2.42% on a 30-day trailing basis over the past week. The CESR staking index, on the other hand, closed flat on the week at 2.90%, narrowing the spread to around -x\4bp.

In terms of market microstructure, utilization actually declined slightly on the week but remains in the mid-seventies..

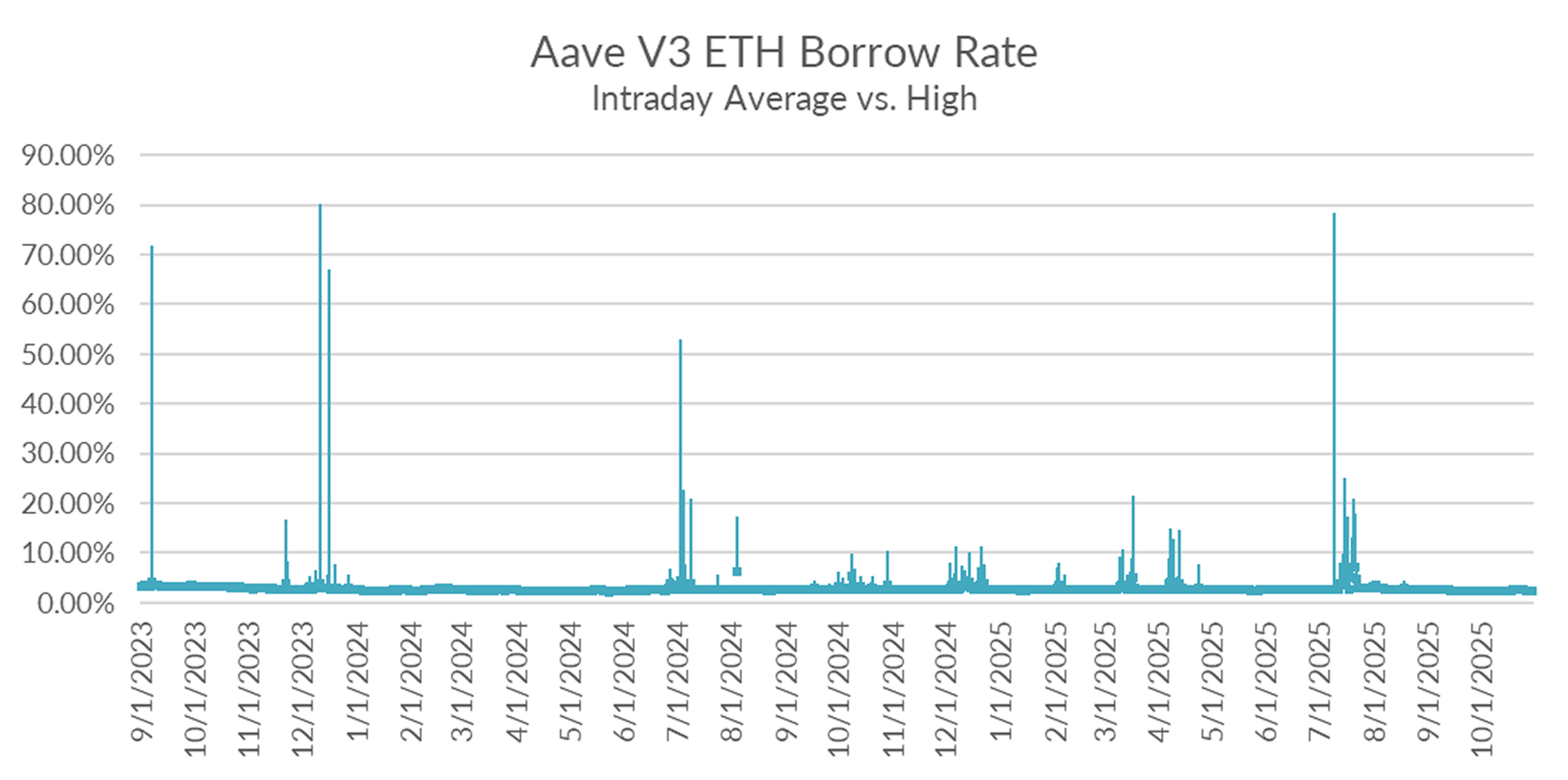

Intraday charts show no signs of stress.

In the near term, expect ETH markets to remains relatively stable.

With US-China relations entering a truce market volatility should decline in the near and medium term On the other hand, Fed Chai Powell has put the December meeting in play for no-change, putting a thumb on the scale against full risk-on price action. With these two dynamics at play expect further gains to be muted. There appears to be large sellers in the crypto market on every pop.