.png)

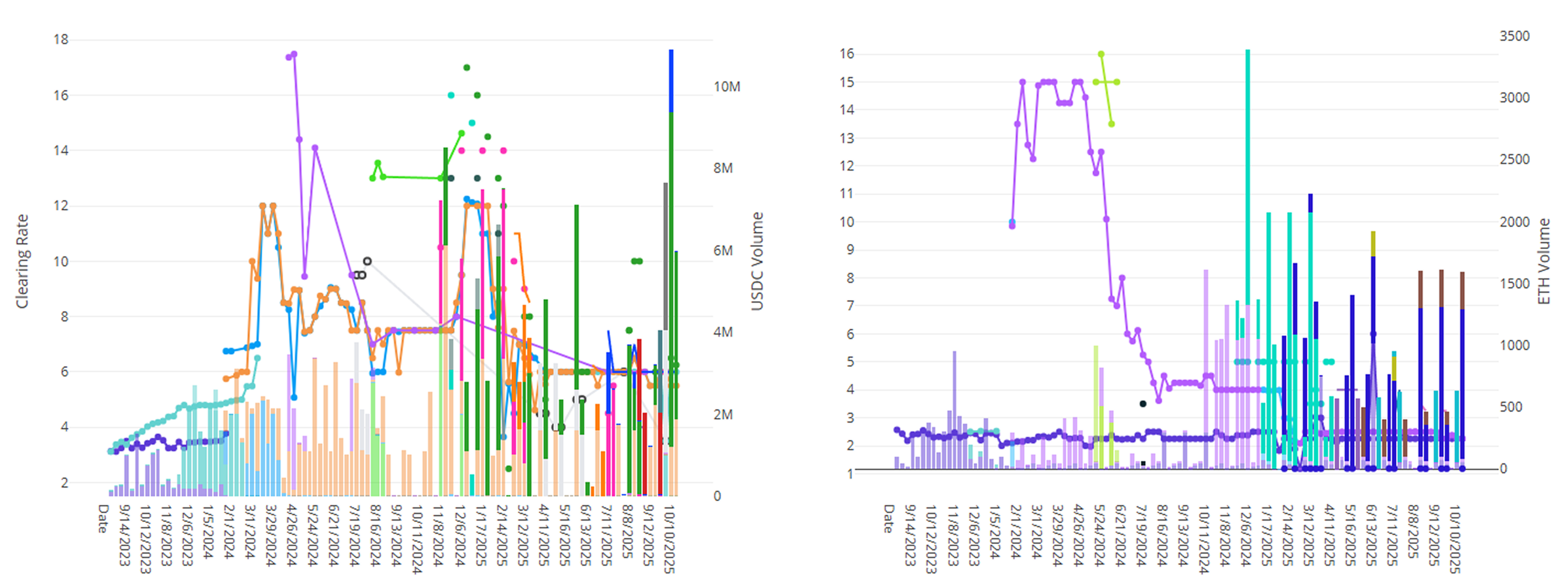

Term cleared ~6M in stablecoin loans and ~ 1600 ETH this week for a total of around 12M total weekly volume— another record for Term. On the stablecoin side, 4M cleared against PT-sUSDE on Plasma with the remainder split between Mainnet and Avalanche against blue-chip collateral. On the ETH side, ynETH an ETH+ loans continue to roll.

For those eager to lock in fixed rates and hedge against further declines in lending rates, visit our Blue Sheets Simple Earn page to explore current opportunities (Not available to U.S. persons).

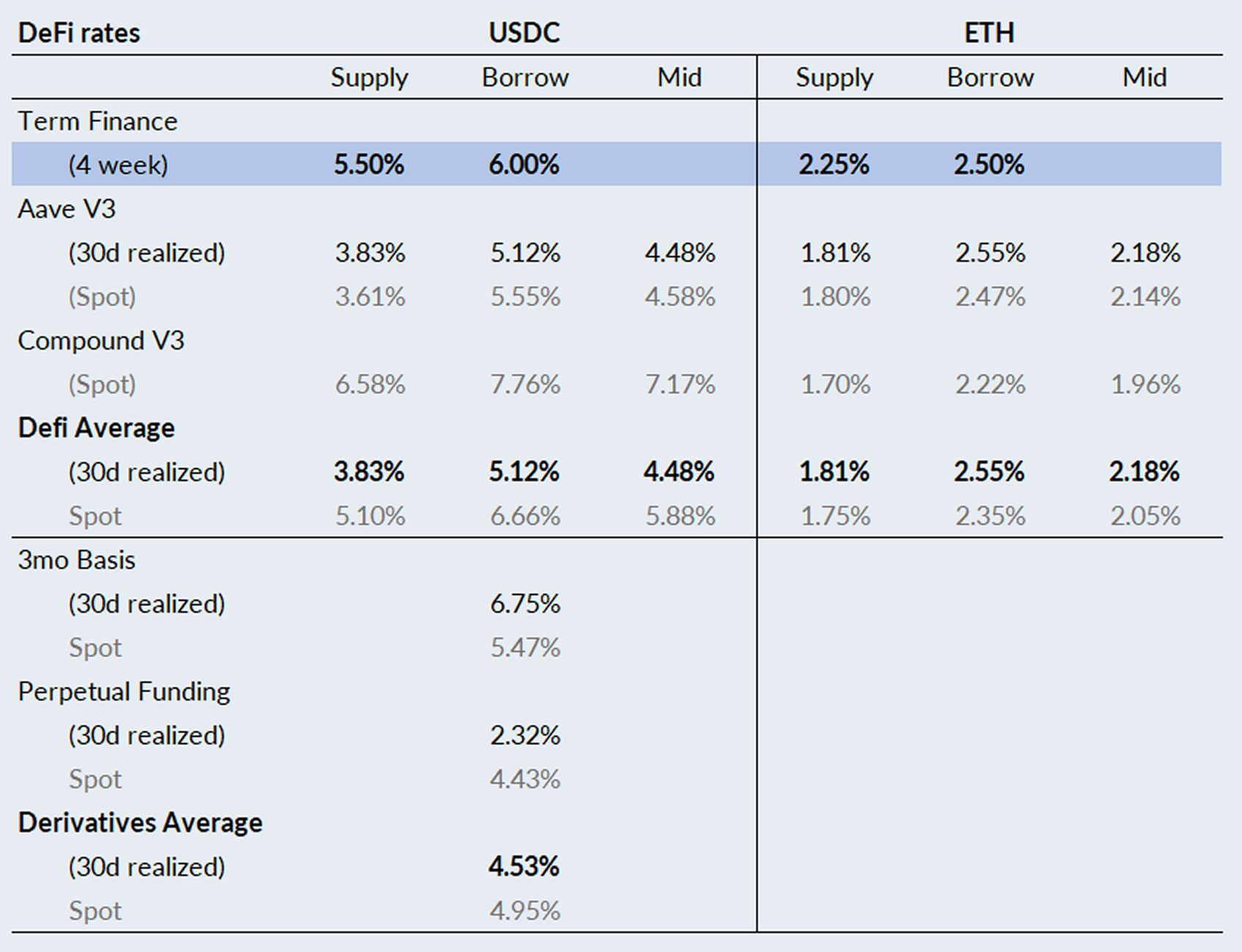

Basis and Perpetuals Markets

In derivatives markets, funding rates collapsed, with 3-month basis falling -13bps to 6.75% and perpetual funding rates a full -266bps to 2.32% on a 30-day trailing basis. The move was largely driven by the crypto “Black Friday” sell-off, during which perp rates plunged to as low as -49.75% as levered longs were liquidated and perps were used broadly as a market hedge.

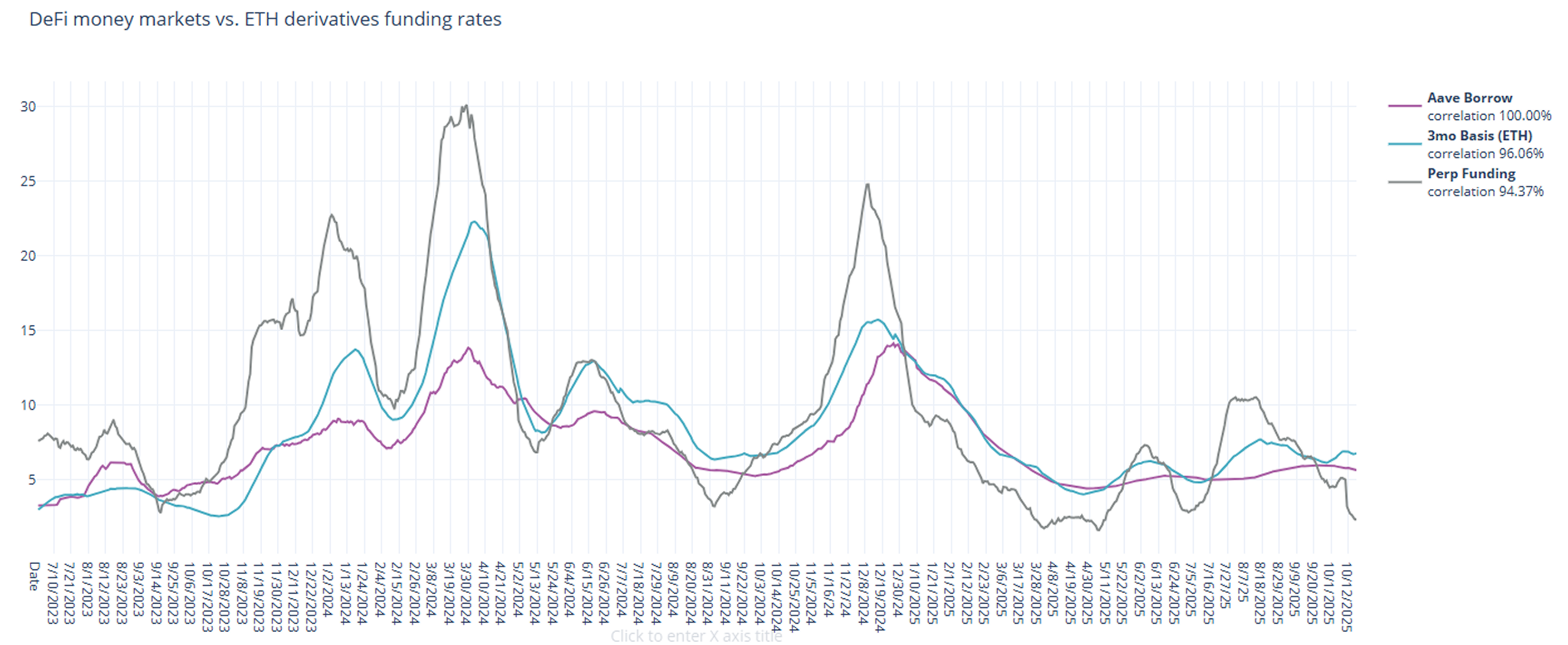

With derivatives funding rates collapsing, the ratio between DeFi and derivatives funding spike up towards historical wides.

Despite the extreme negative rates seen last Friday in perp markets last Friday, the decline in 3-mo basis has been far more measured, reflecting broad deleveraging rather than a full reversal into a bear market. Equity markets, in fact, have already recovered a substantial portion of last Friday’s decline ahead of the upcoming Trump-Xi meeting next week.

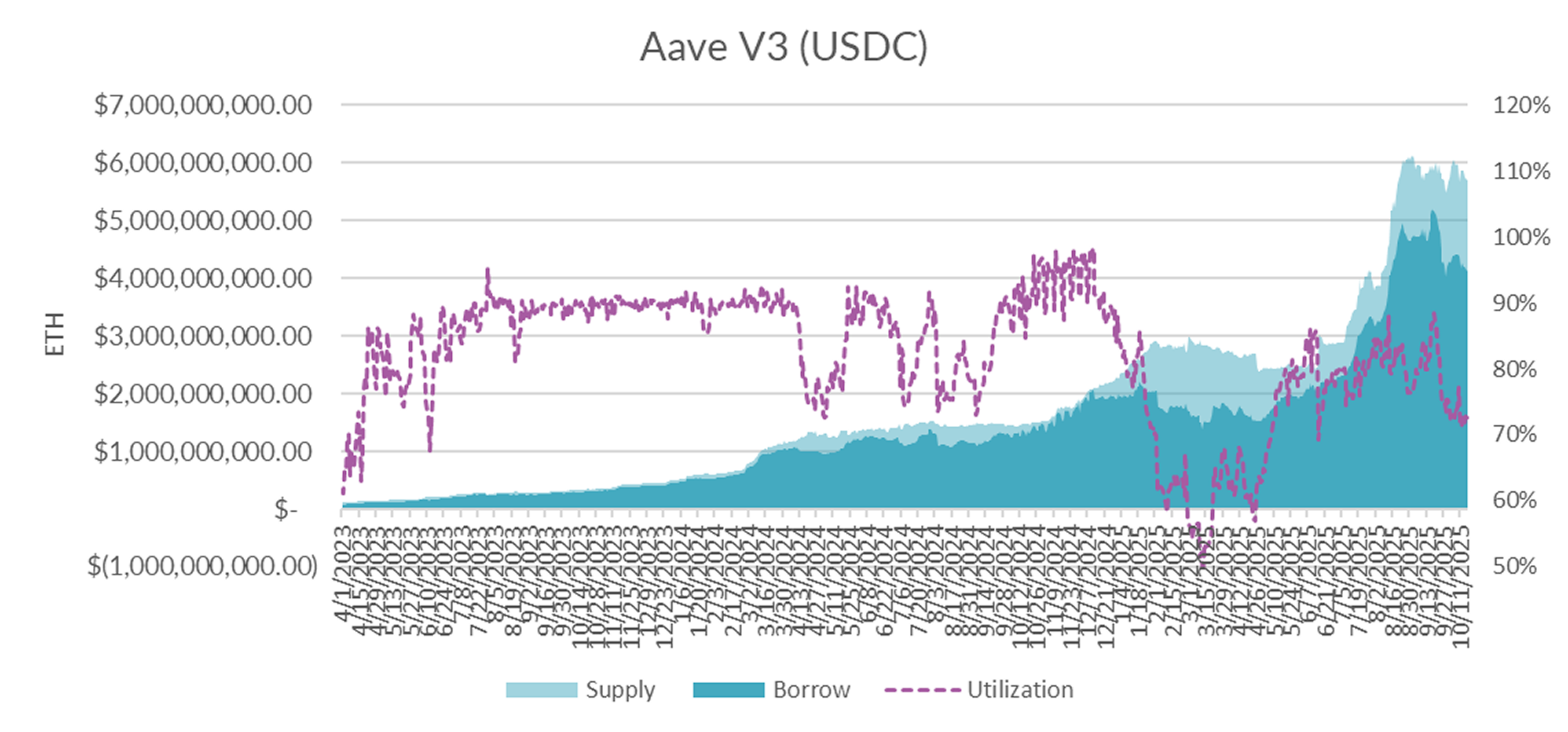

USDC Markets

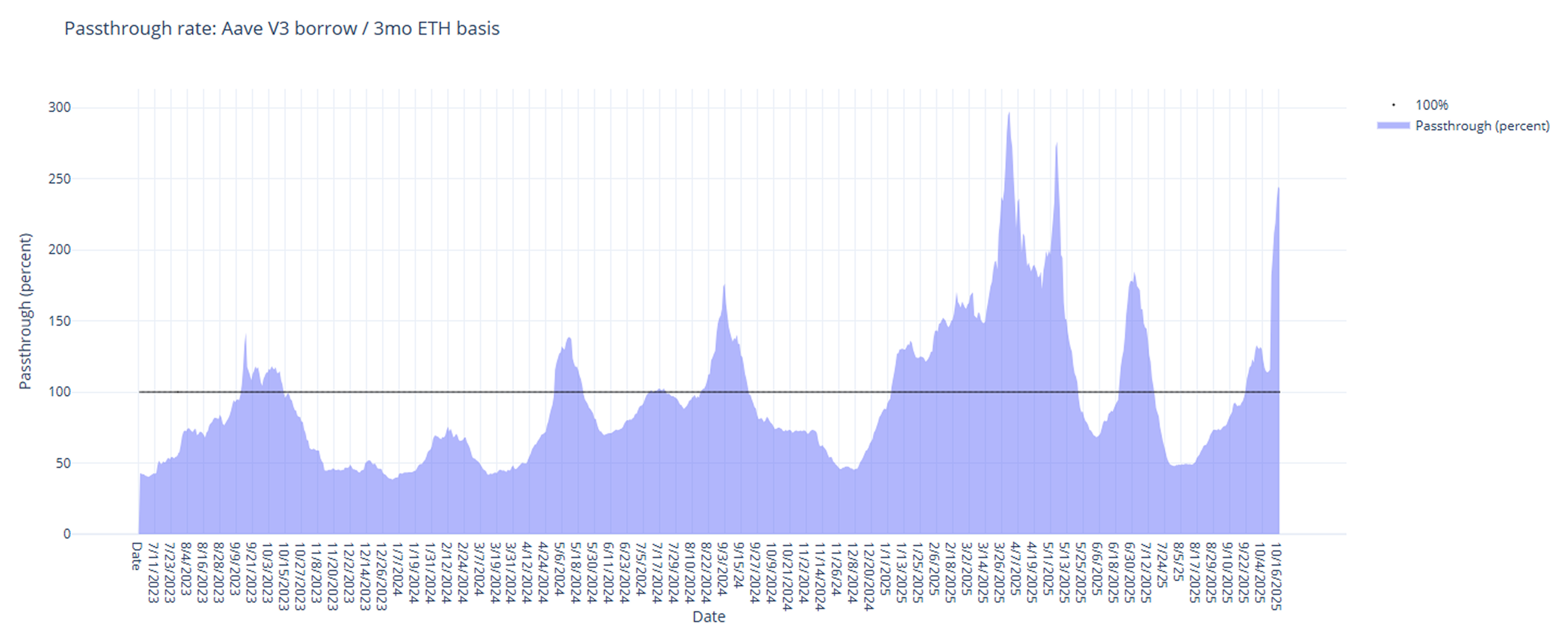

Turning to DeFi variable rate markets, the 30-day trailing average continued to fall, declining by -13bps to 5.63% on a 30-day trailing basis. On a shorter lookback period, USDC borrow rates averaged 6.40% driven in large part by a sharp pullback in liquidity that took rates up to 12.70% intraday last Friday.

Diving into the microstructure of Aave's USDC markets, internal metrics suggest a pattern consistent with the broader deleveraging seen in derivatives markets. While USDC supply remained relatively stable, borrow demand declined by -262M over the same period, driving utilization down by -5 percentage points.

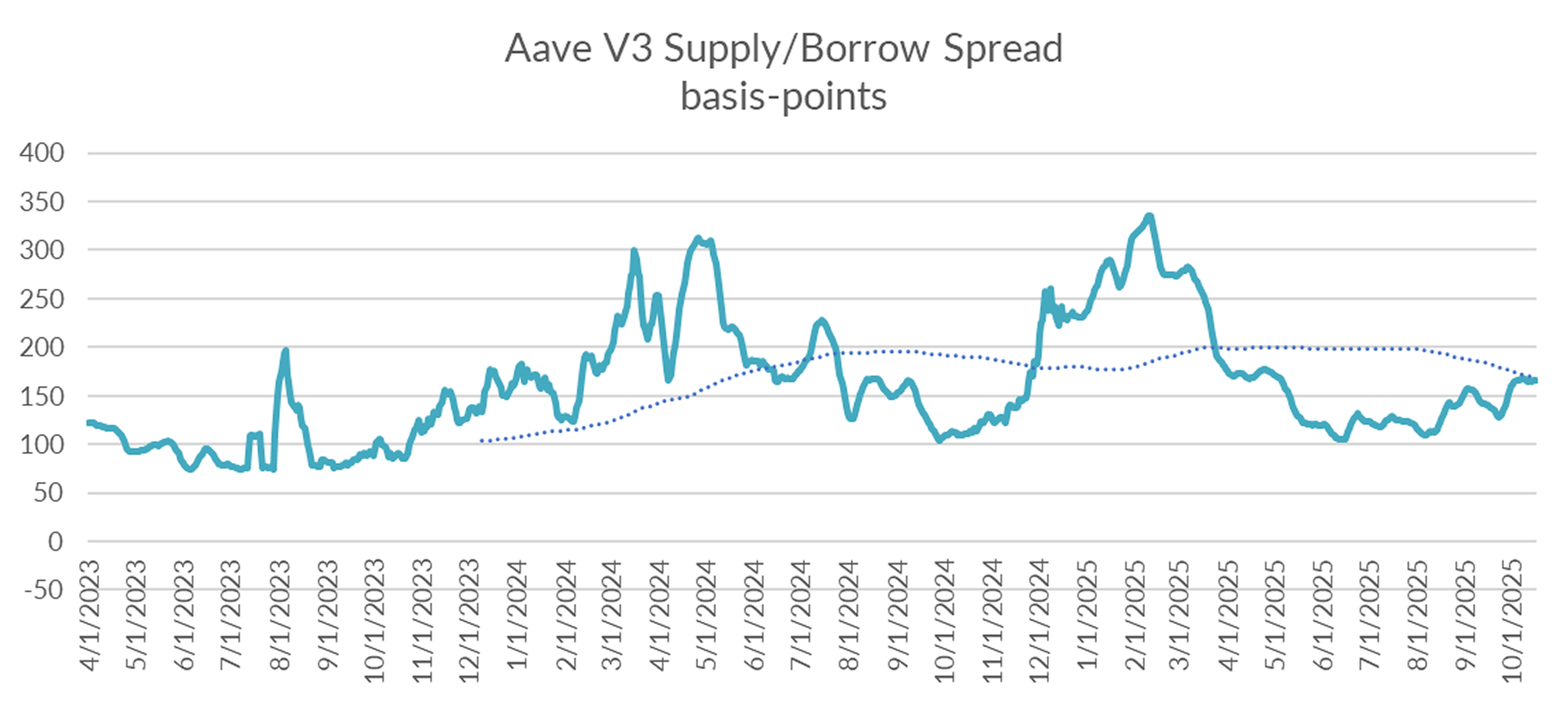

In line with declining utilization rates, the spread between borrow and supply rates on Aave have been on the rise, closing the week back at the long term historical average of ~165bps.

A glimpse into intraday rate dynamics show a brief spike in borrow rates last Friday (upwards of 12%+) reflecting some minor and short-lived stress in funding markets on the market selloff.

Whether DeFi markets will continue to de-lever or hold steady is hard to tell. The initial knee-jerk reaction to last week’s events was to play defense, but with market volatility quickly declining over the past week days it appears as if the market is in wait-and-see mode, pending the highly anticipated meeting between Trump and Xi in a couple weeks.

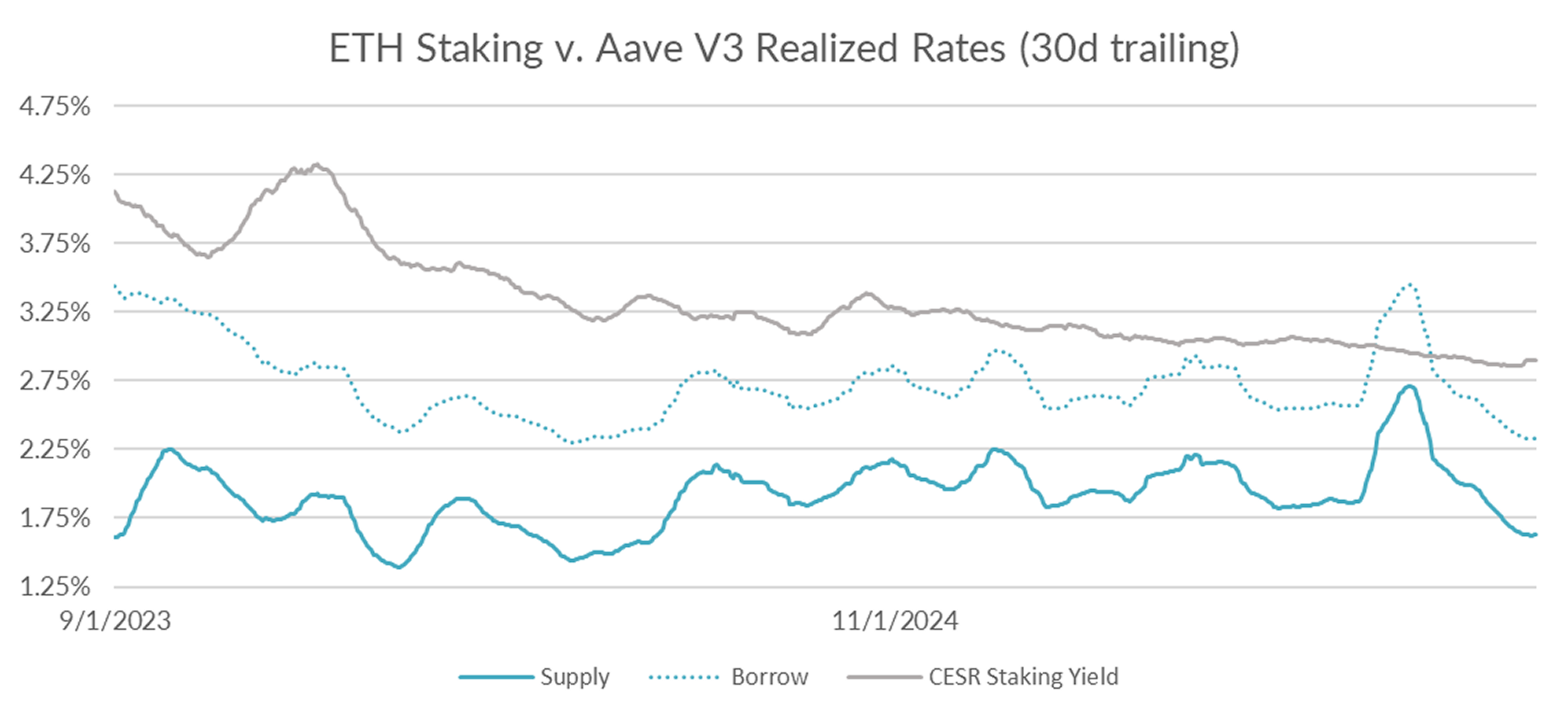

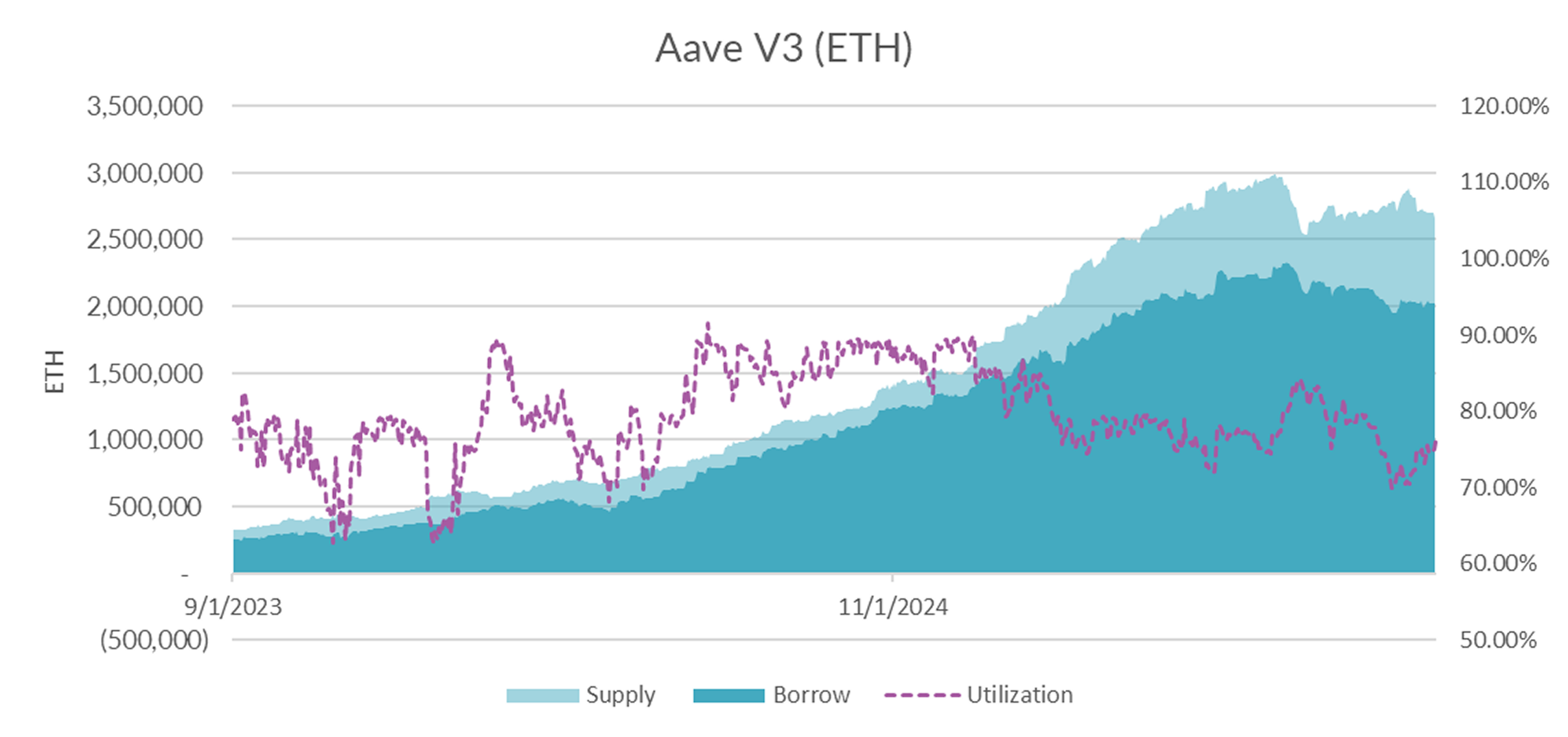

ETH Markets

Turning now to ETH markets, ETH rates fell -1bps to 2.33% on a 30-day trailing basis over the past week. The CESR staking index, on the other hand, closed up +4bps on the week at 2.90% in large part due to heightened on-chain activity last Friday, widening the spread to around 54bp.

In terms of market microstructure, total supply/demand and utilization rose by a slight margin, likely due in part to a decline in supply from broader deleveraging in DeFi markets.

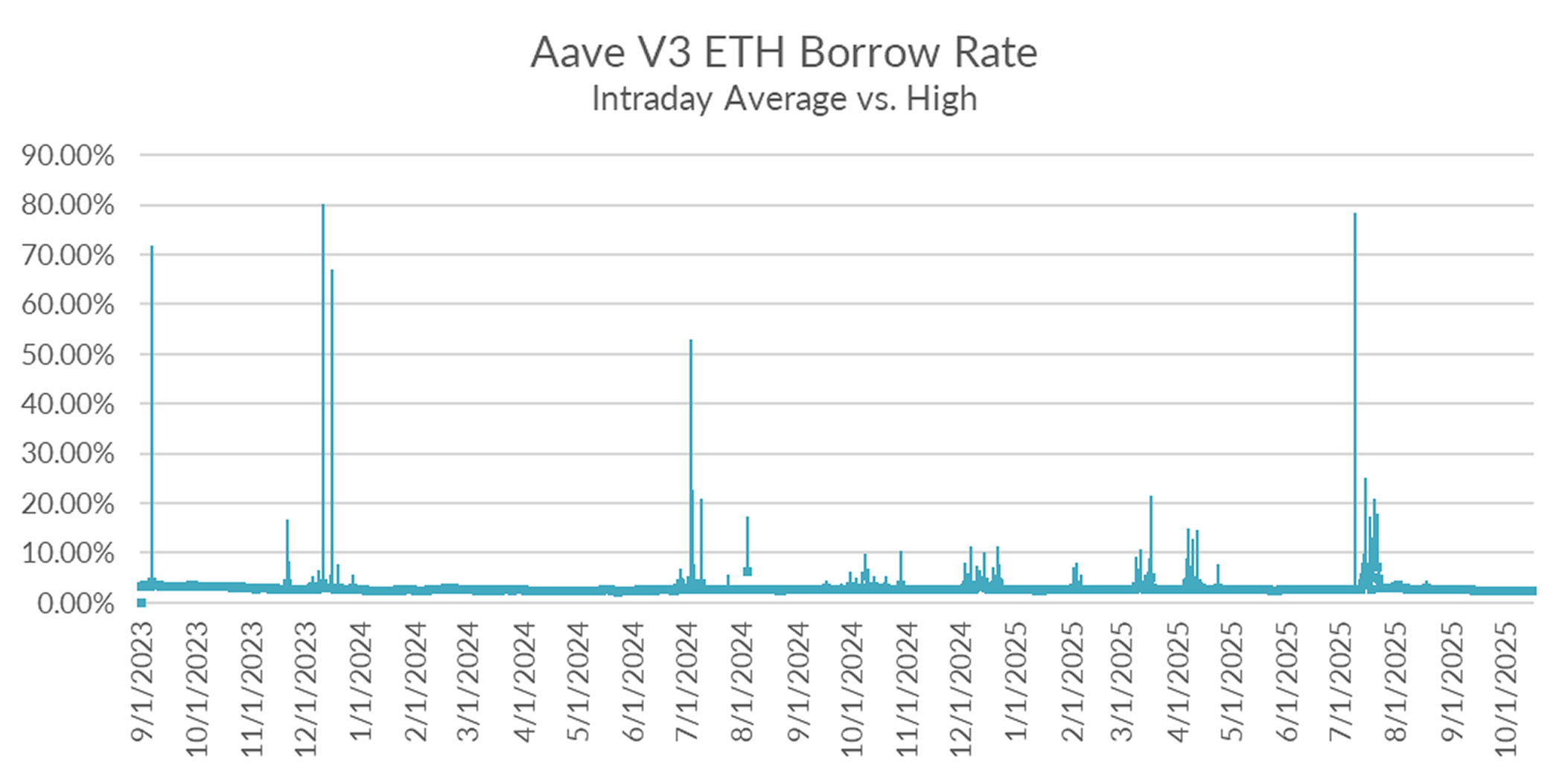

Intraday charts show no signs of spillover from last week’s events into ETH money markets.

In the near term, expect ETH markets to remains relatively stable pending further news on US-China trade over the next few weeks.

DeFi has seen ~3 years of relative calm with very few 2-3 sigma trading days to act as a check on the system. This has allowed risk and leverage to build up and accumulate over a sustained period of time. Last week was the first “stress test” to shake out weak hands in a long while. While equity markets have bounced back from last week’s selloff to a large extent, crypto markets close the week towards the low end of the recent range. Until further news on US-China trade emerges, crypto assets to remain weak and rates to subdued.