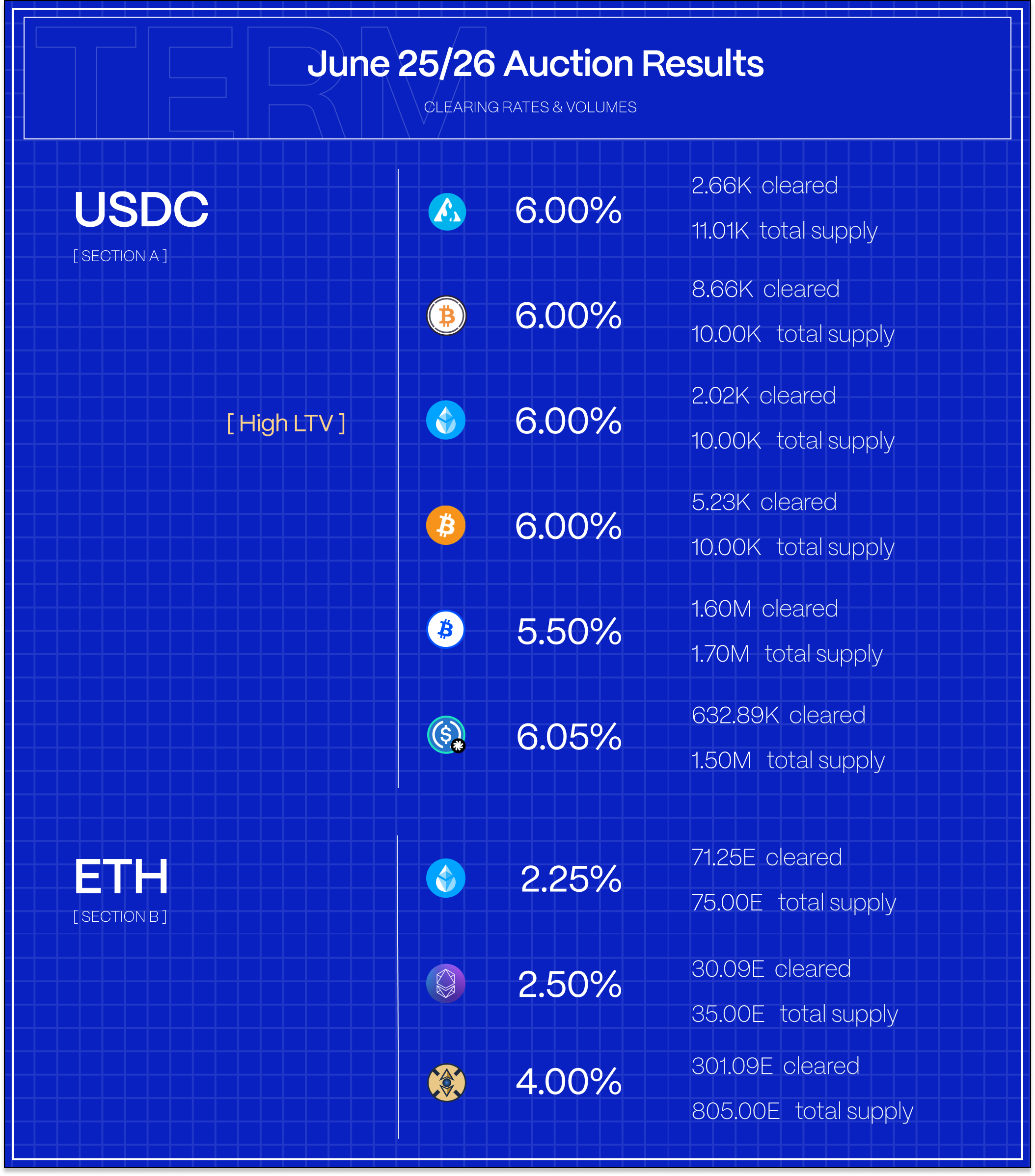

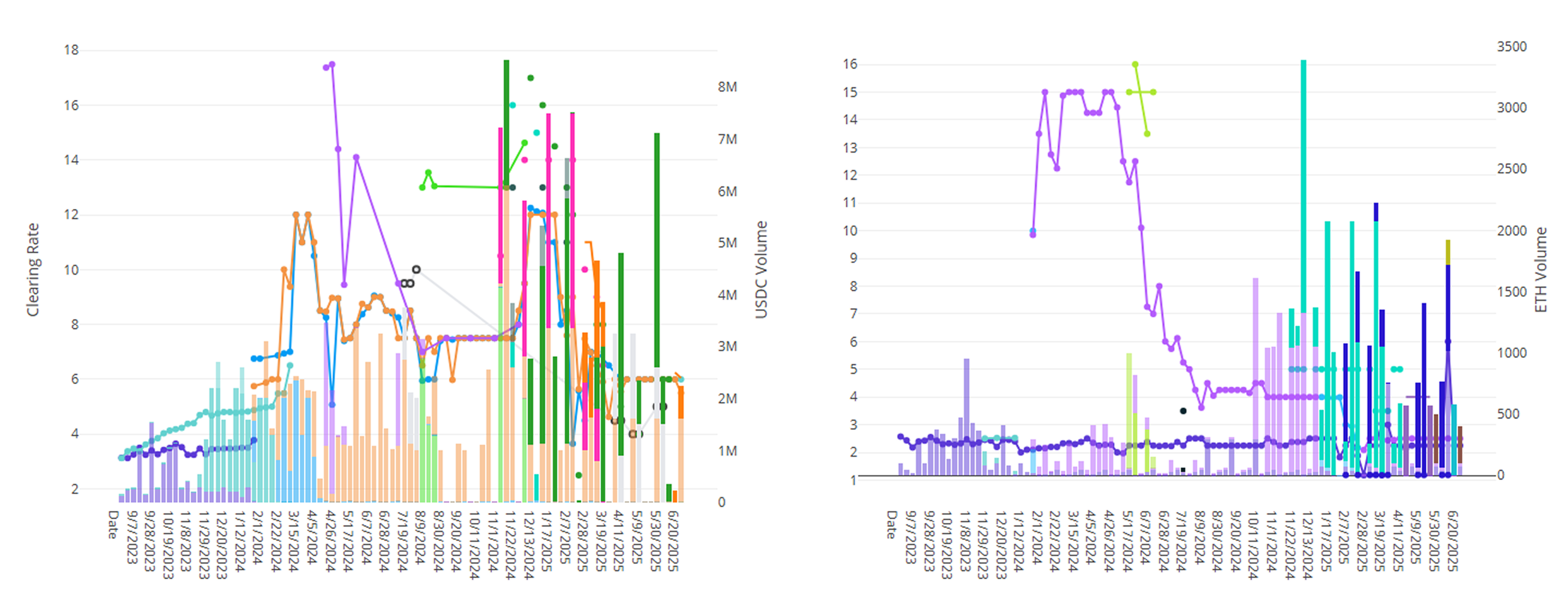

Rates on Term dipped slightly this week across the board. USDC rates fell against both blue-chip cbBTC collateral and superUSD Pendle Tokens. On the ETH side, demand against exotics remain robust.

For those eager to lock in fixed rates and hedge against further declines in lending rates, visit our Blue Sheets Simple Earn page to explore current opportunities (Not available to U.S. persons).

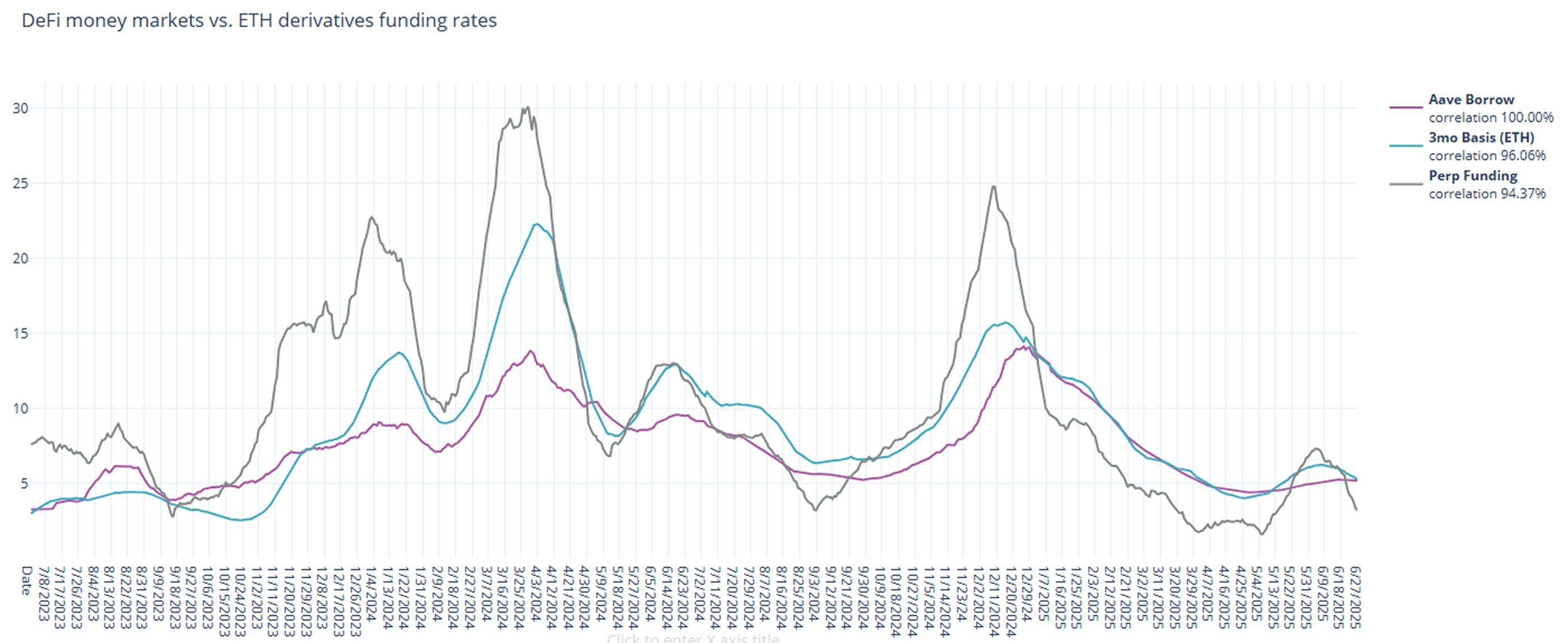

In derivatives markets, funding rates continue to drop like a rock. On a 30-day trailing basis, 3-month basis fell by -48bps to 5.29% and perpetual funding rates fell by a whopping -236bps, down to close the week at 3.18%.

DeFi rates, on the other hand, have been relatively stable, causing the spread between DeFi and derivatives to widen drastically back toward recent extremes.

While cryptoasset prices are back near all-time highs, the lack of follow through and heightened geopolitical uncertainty puts a cap on leveraged borrow demand in derivatives and in DeFi. Expect derivatives rates to remain stagnant in the near term.

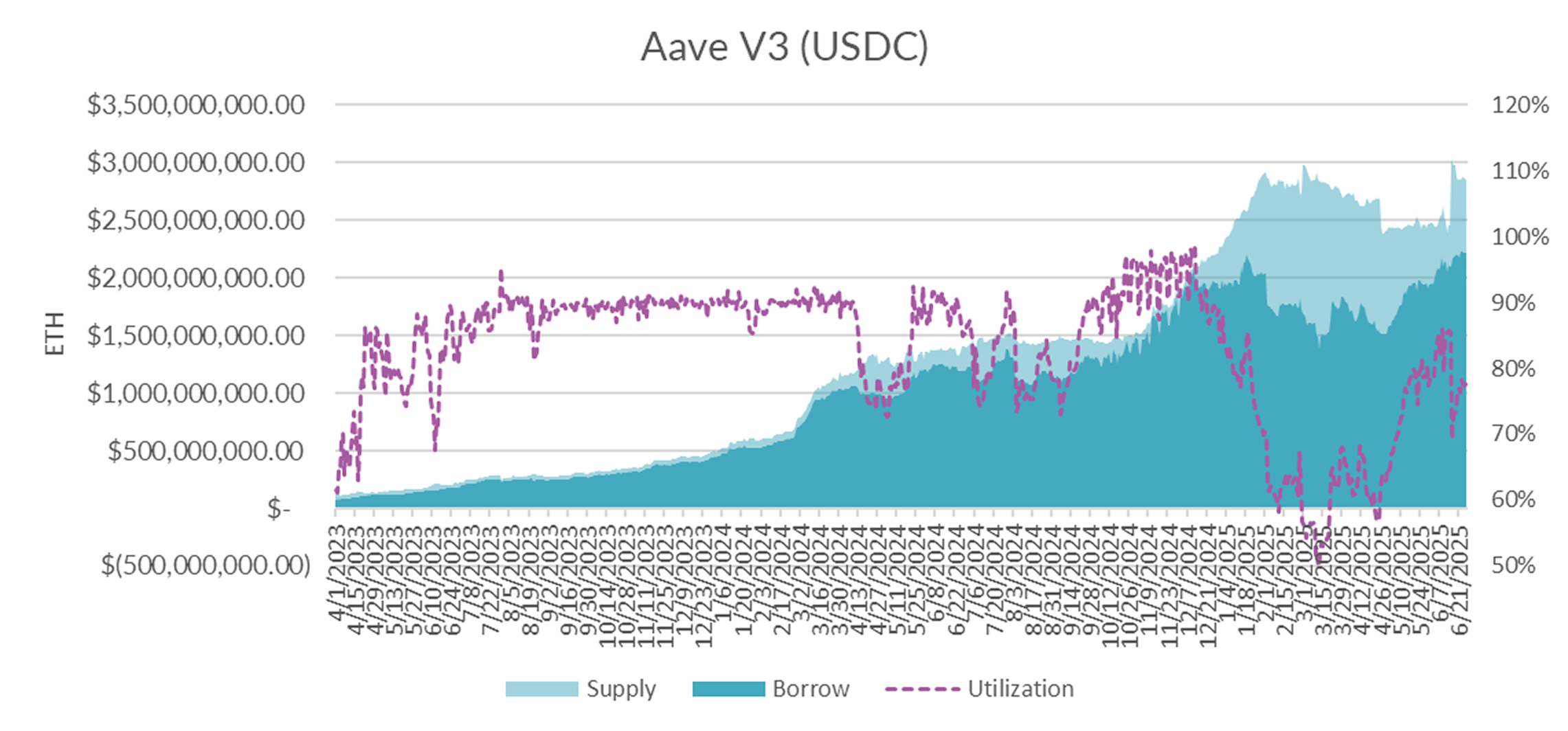

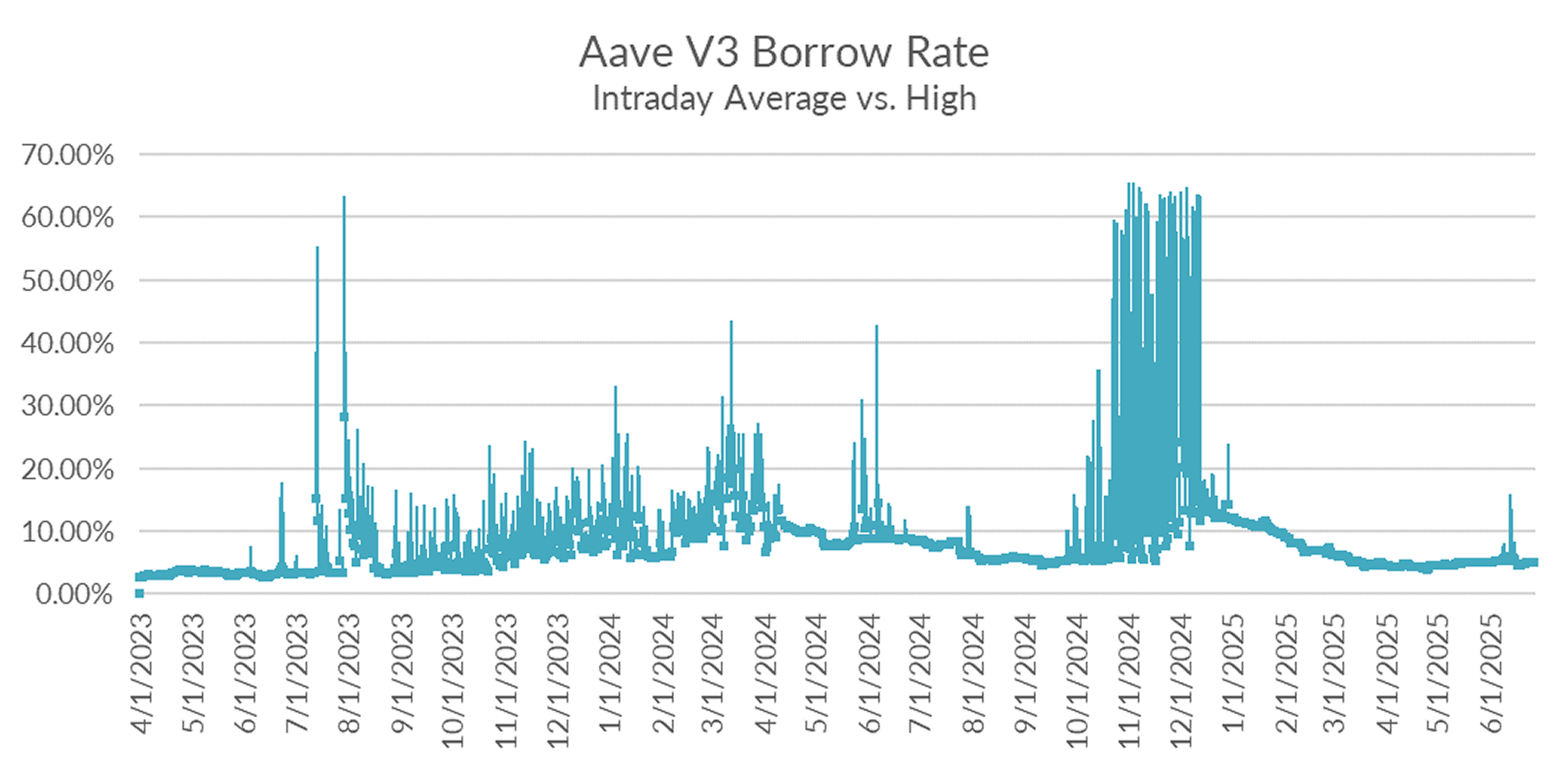

Turning to DeFi variable rate markets, the 30-day trailing average fell -3bps on the week to 5.18%. Over a shorter lookback period (just seven days), Aave borrow rates averaged 4.94% on the week, suggesting further declines ahead.

Diving into the microstructure of Aave's USDC markets, utilization fell into the high 70s, with lower utilization largely driven by a surge in total supply over the last couple of weeks.

With the overall market relatively balanced, borrow-supply spreads remain near the low end of the range, though it has been on the rise in recent days.

And while the brief spike in demand from a couple of weeks ago were helpful in driving in new supply, demand for USDC has plateaued around 2.2BN causing the market to settle into a new equilibrium.

In the near term, markets appear relatively balanced and are expected to remain steady absent significant macro disruptions.

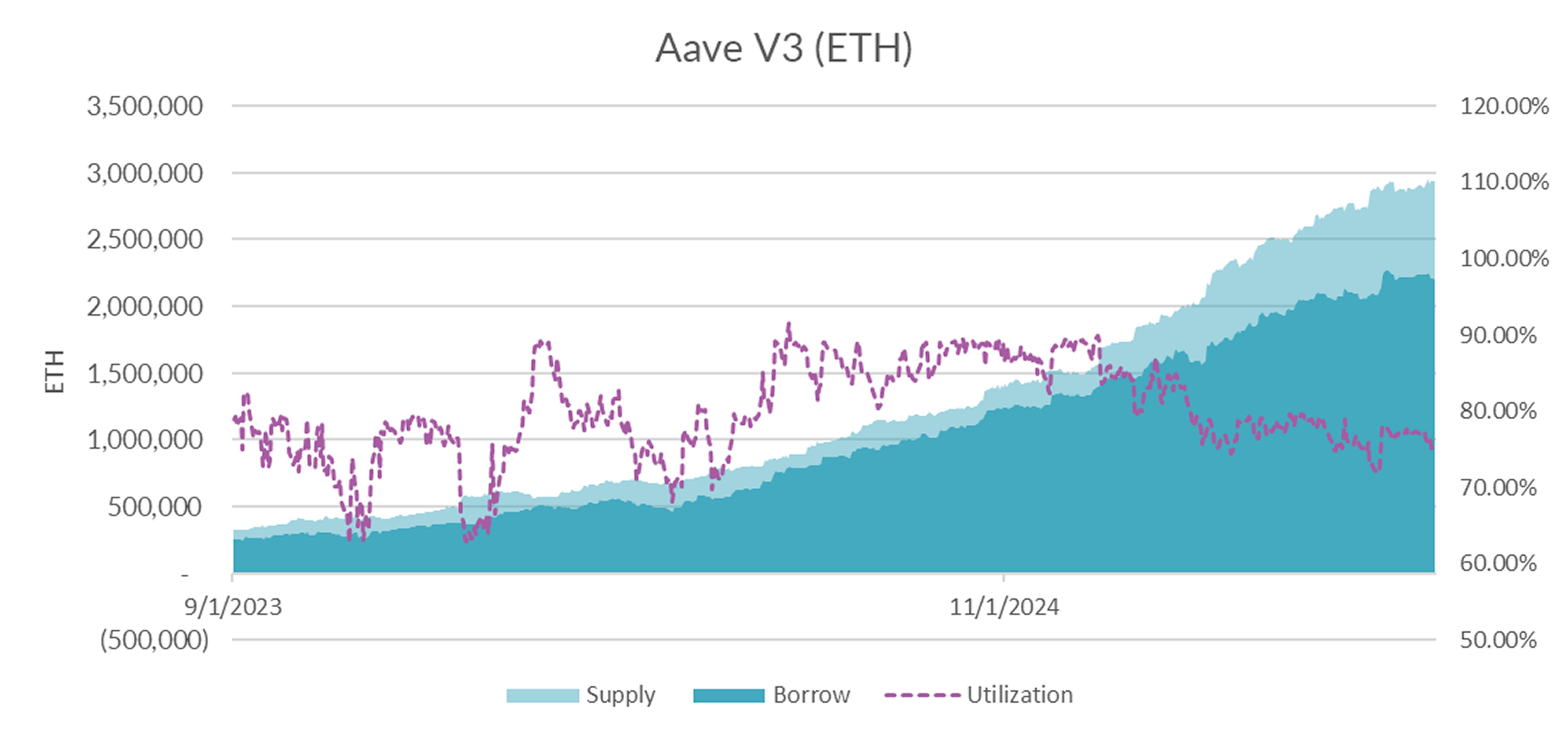

Turning now to ETH markets, ETH rates rose by +2bp on the week to 2.58% on a 30-day trailing basis. The CESR staking index, on the other hand, held steady at 3.04%, narrowing the spread by -2bp on a 30-day trailing basis.

Market internals show that supply (+36k ETH) rose while demand fell (-34k ETH) over the past week, suggesting lower rates ahead.

With ETH rangebound at current levels, expect borrow rates to find a floor around 2.5%.

This level implies ~0.5% spread between staking and borrowing rates, which gets looping yields up towards the targe 8% range that attracts many ETH denominated DeFi funds.

Fears of a war in Iran quickly subsided with a ceasefire earlier this week that has take crypto back towards all-time highs. Week-on-week price action, however, masks significant intra-week volatility that saw BTC roundtrip between 110k—>99K and back in just a handful of days. This type of price action tends to drive liquidations and wipe out leveraged, hence the sharp decline in perpetual funding rates. With elevated geopolitical risks under Trump, expect this to keep markets honest and cap perp rates on the upside.