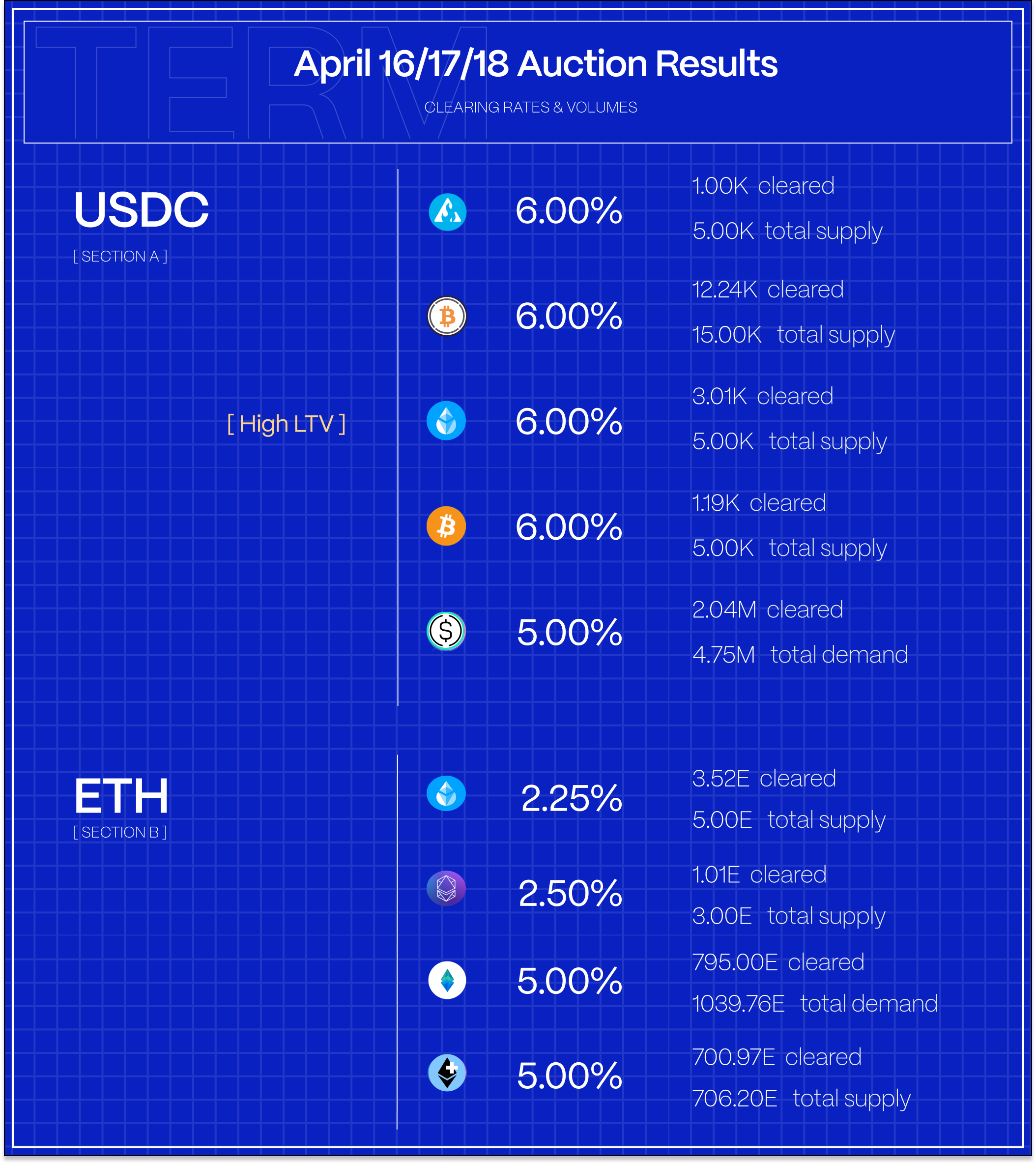

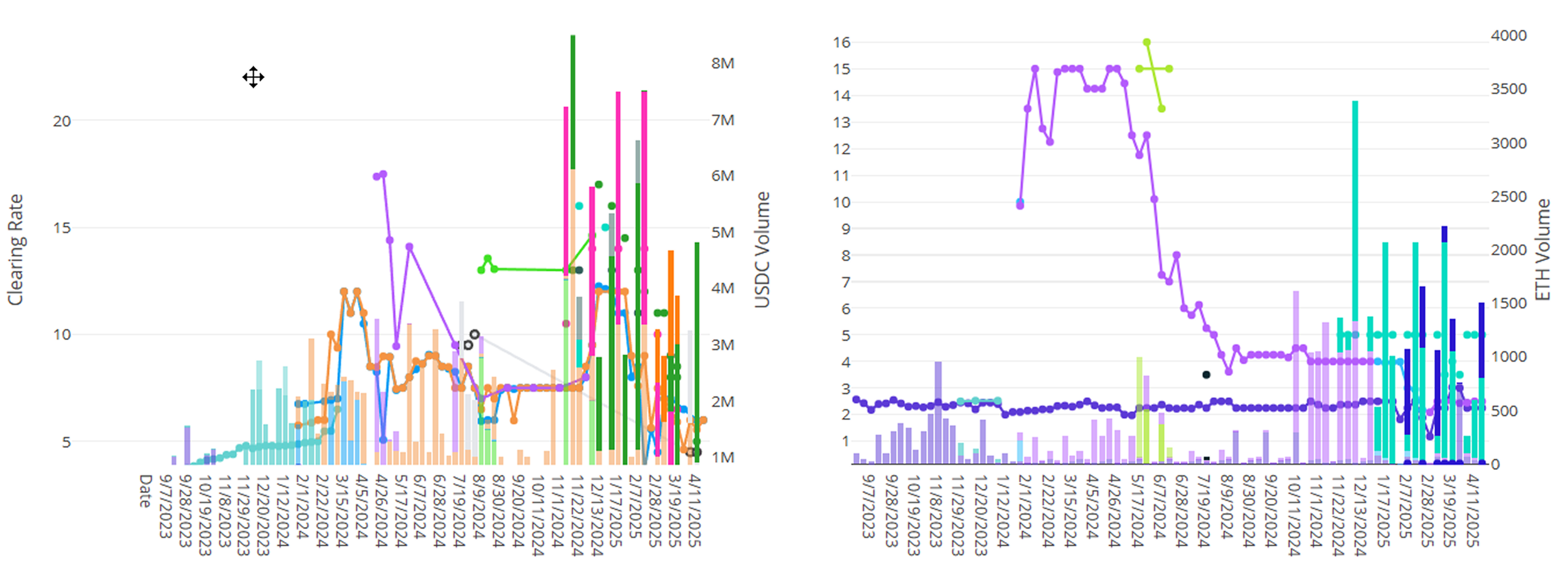

Rates were steady on Term this week. USDC volumes against the majors were light but the Protocol saw decent interest in borrowing against PT-sUSDE-Mays with a total 4.75M in new demand. In ETH markets, rates were unchanged from the week prior with auctions clearing against the majors in the 2.25-2.5% range and those against exotics ~5%.

For those eager to lock in fixed rates and hedge against further declines in lending rates, visit our Blue Sheets Simple Earn page to explore current opportunities (Not available to U.S. persons).

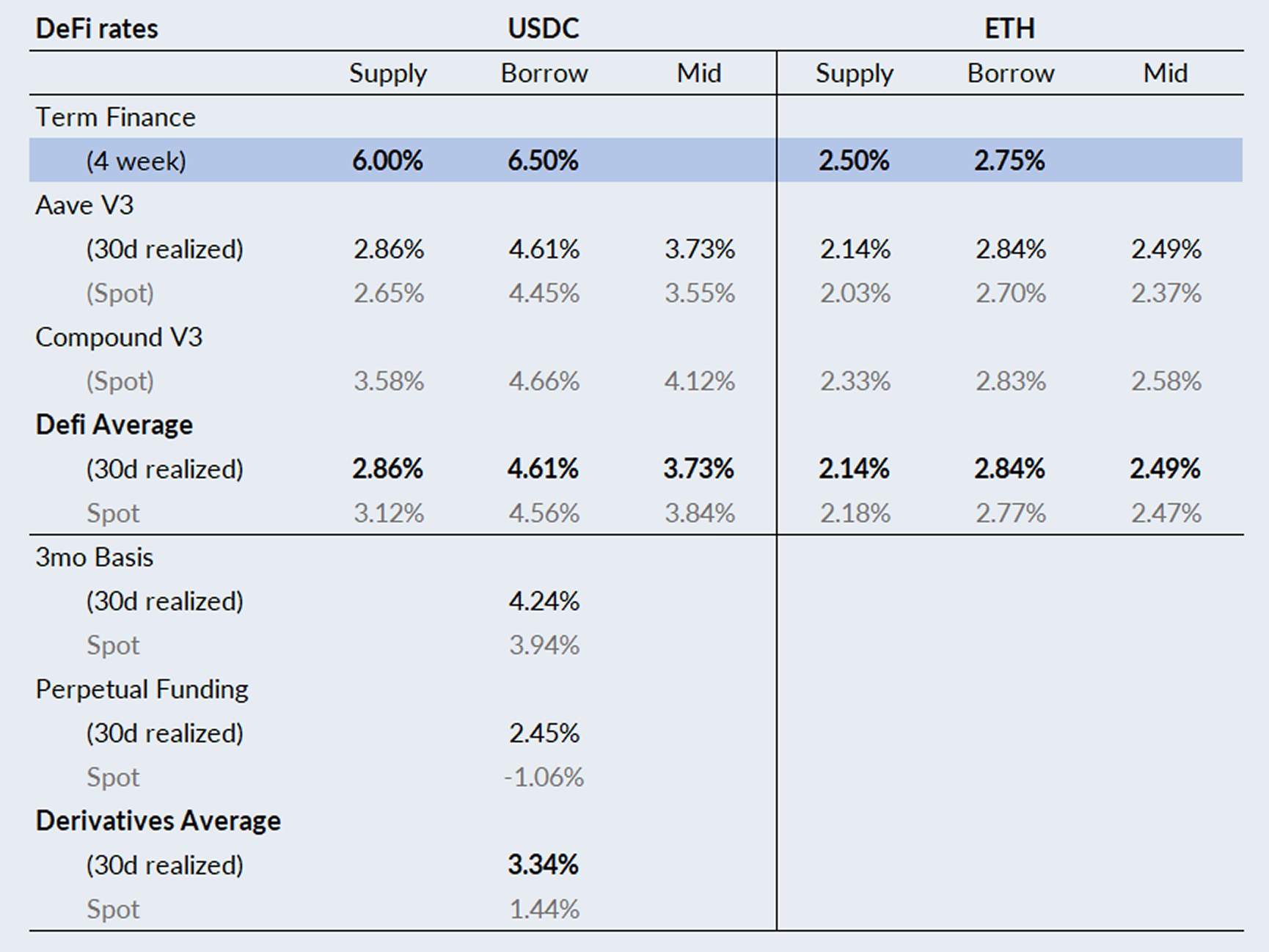

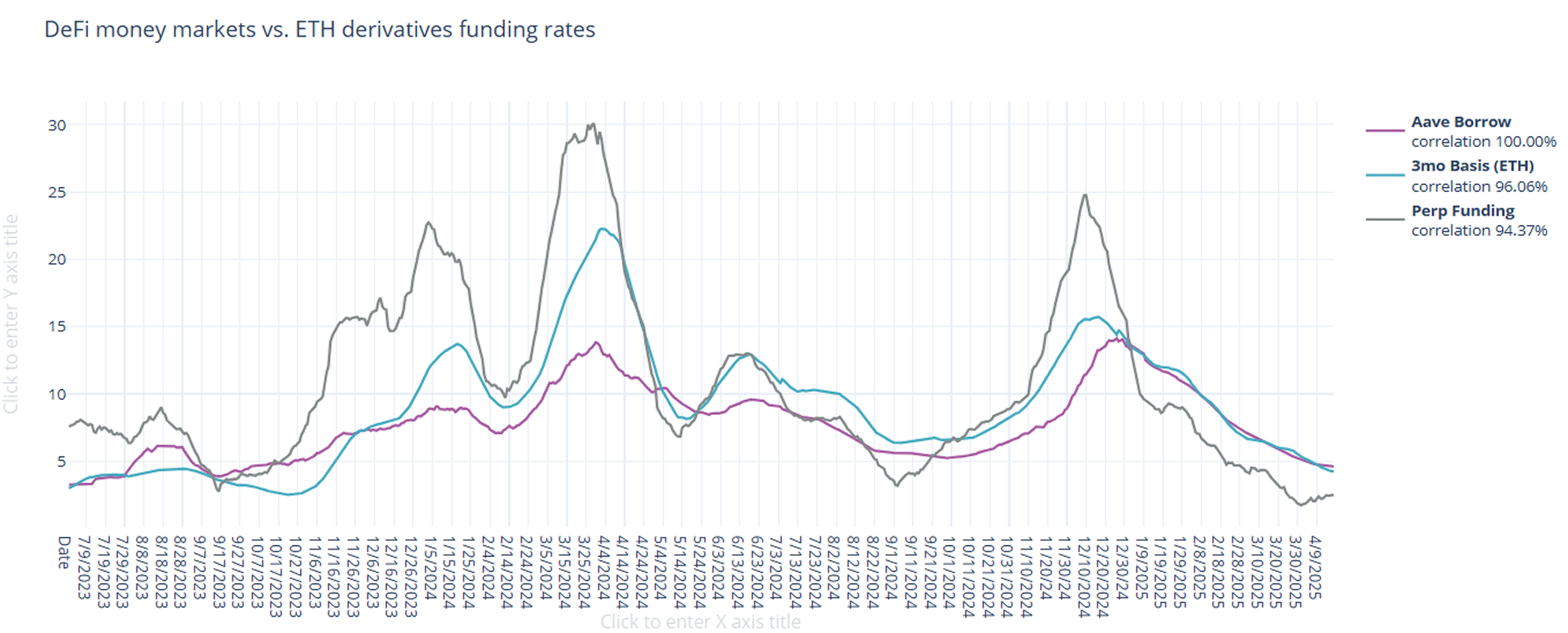

In derivatives markets, funding rates were mixed, with 3-month basis falling by -34bps to 4.24% and perpetual funding rates rising, for the second week in a row, to 2.45% on a 30-day trailing basis.

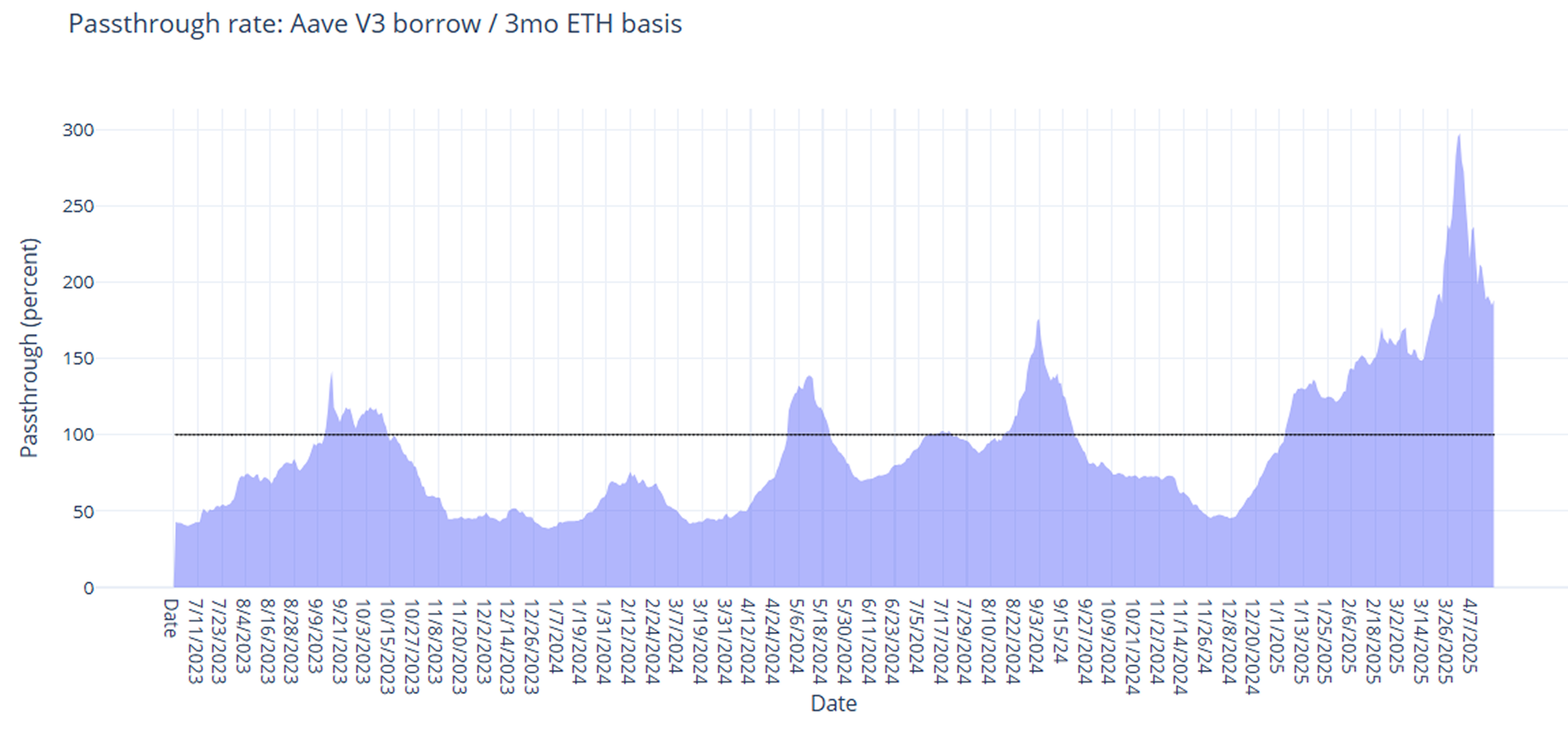

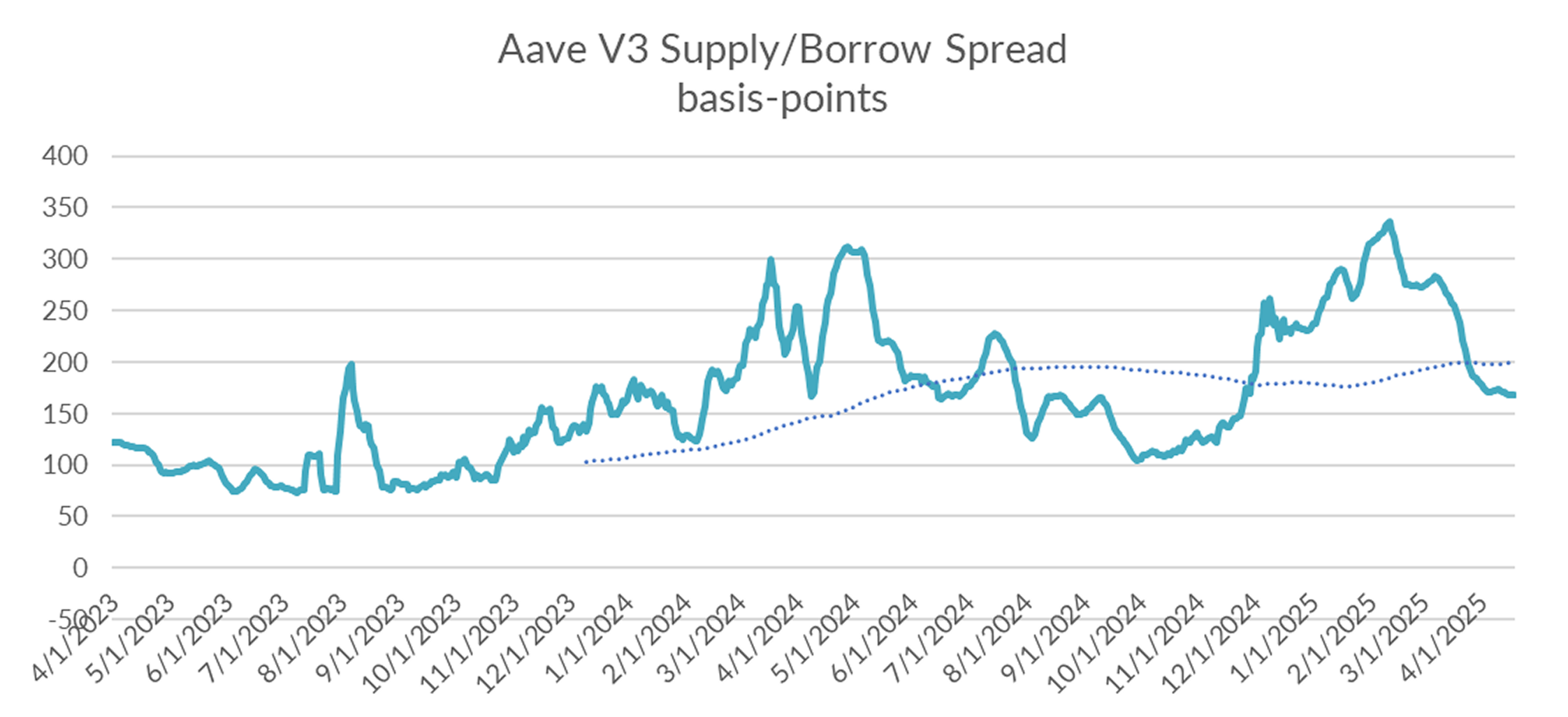

DeFi rates held steady on the week, narrowing the spread between DeFi and derivatives rates by roughly -32bps.

Despite this compression, spreads remain well above prior highs and is still quite a ways from inverting back to historical norms where derivatives rates tend to yield higher than its DeFi counterparts.

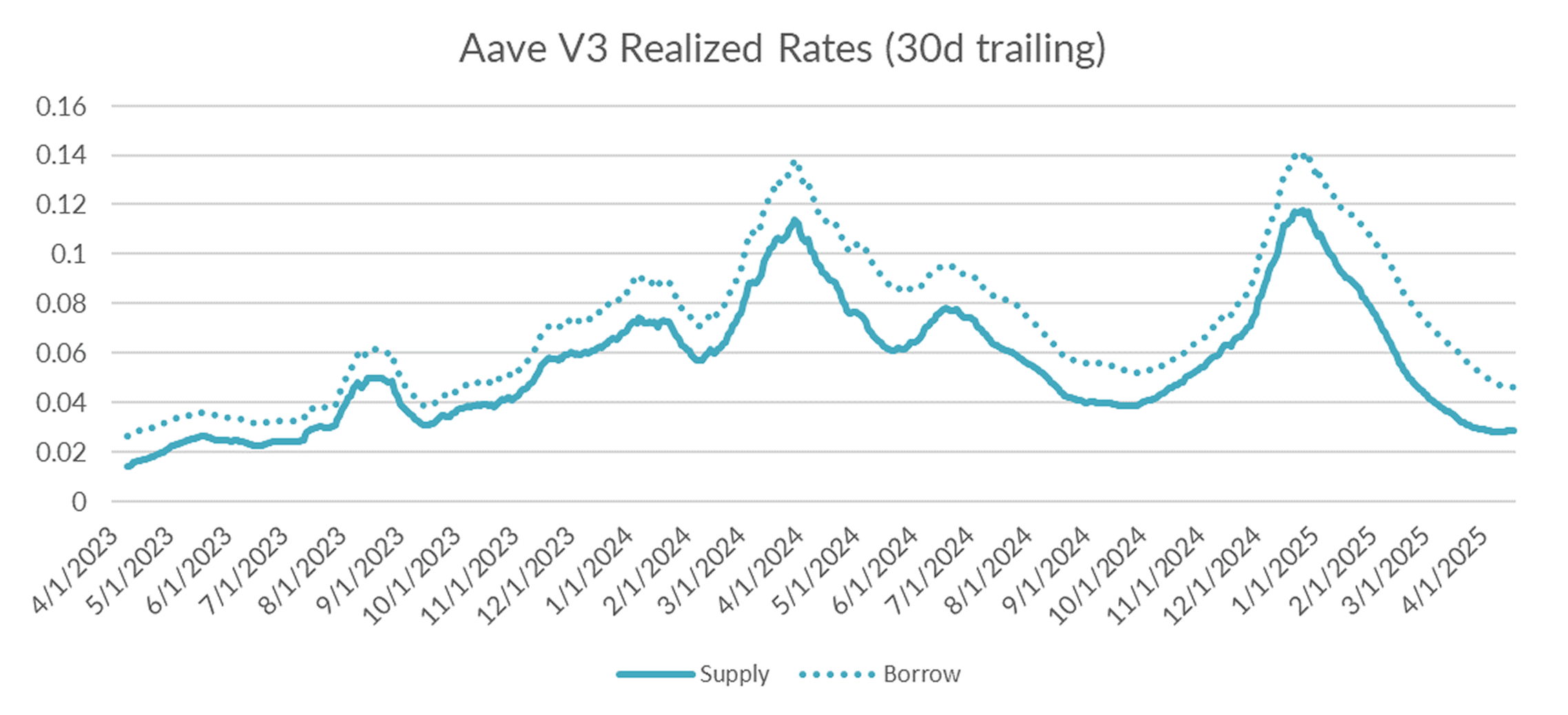

Turning to DeFi variable rate markets, the 30-day trailing average declined just -9bps on the week to 4.69%, down from -27bps change the week prior. Over a shorter lookback period (just seven days), Aave borrow rates averaged 4.58% on the week, foreshadowing continued consolidation ahead.

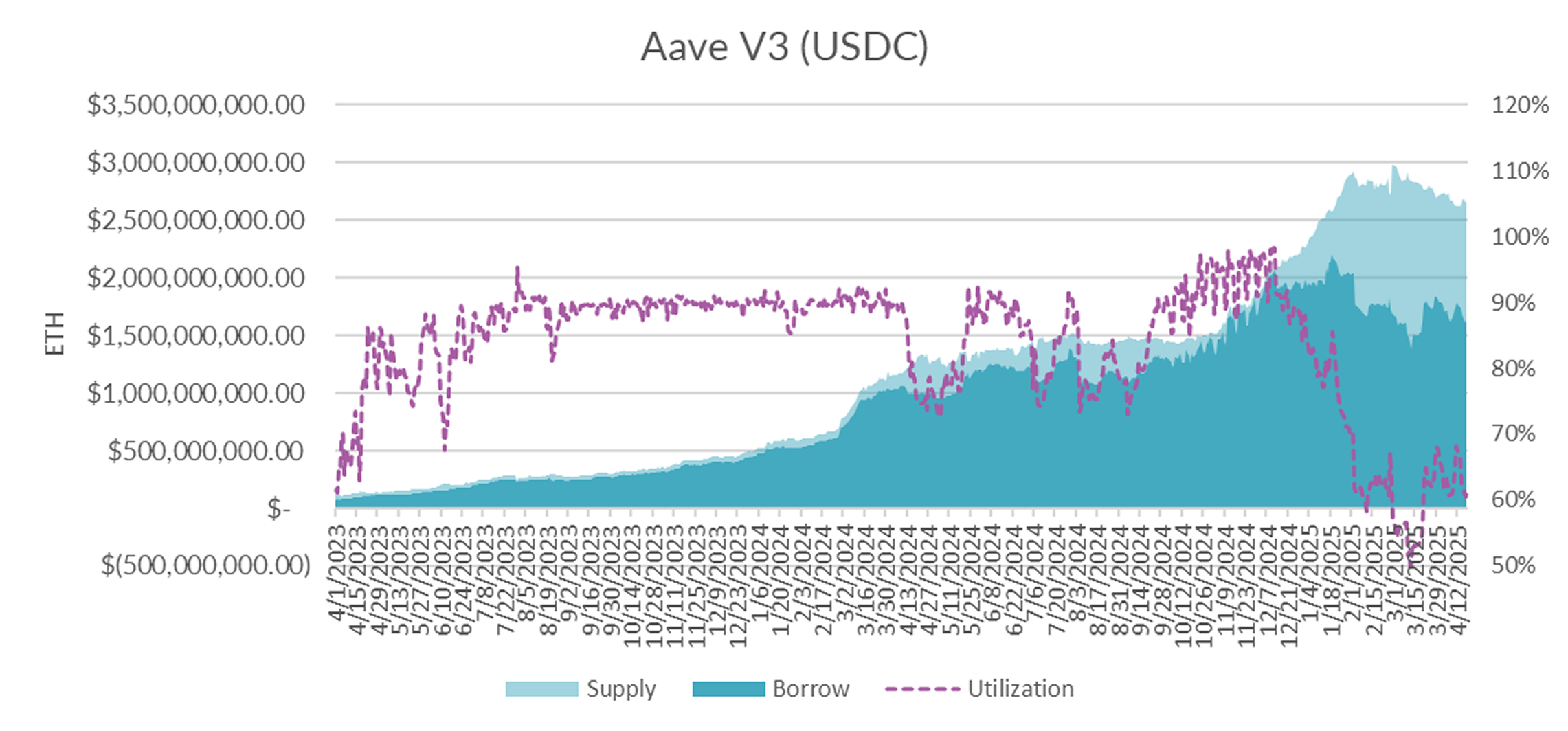

Diving in the microstructure of Aave USDC markets, utilization dipped to 61% down from 67% the week prior, due to a combination of increasing supply and declining borrow demand (+33M supply, -163M demand).

Despite the fact that DeFi borrowers can borrow overnight at the same rate as the U.S. government, overall appetite remains weak.

With perp rates in the sub 3% range, it is unlikely that crossover demand from leveraged derivatives markets are likely to boost DeFi borrow demand in the near term.

With perp rates on the mend but still quite a ways from the DeFi borrow rate, expect markets to remain steady and inactive in the near term.

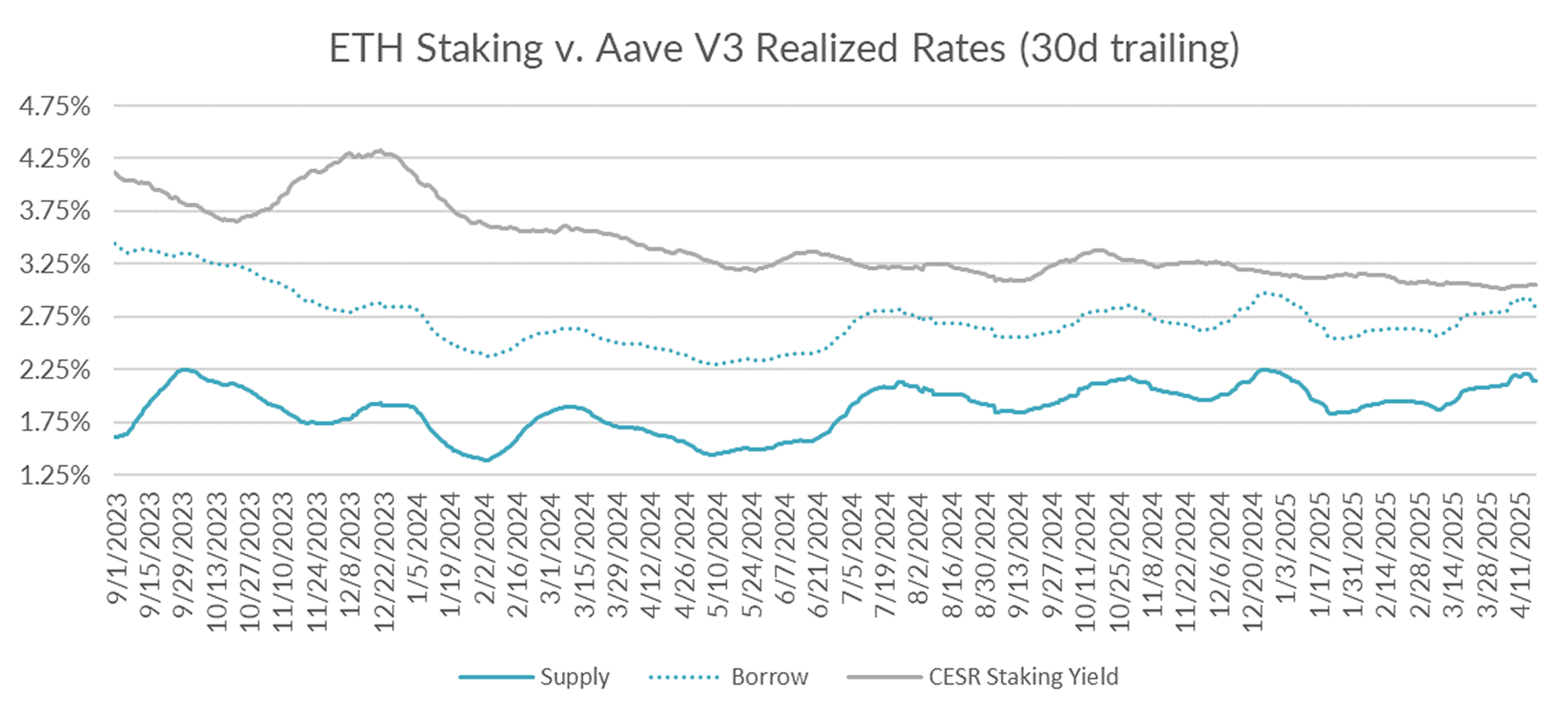

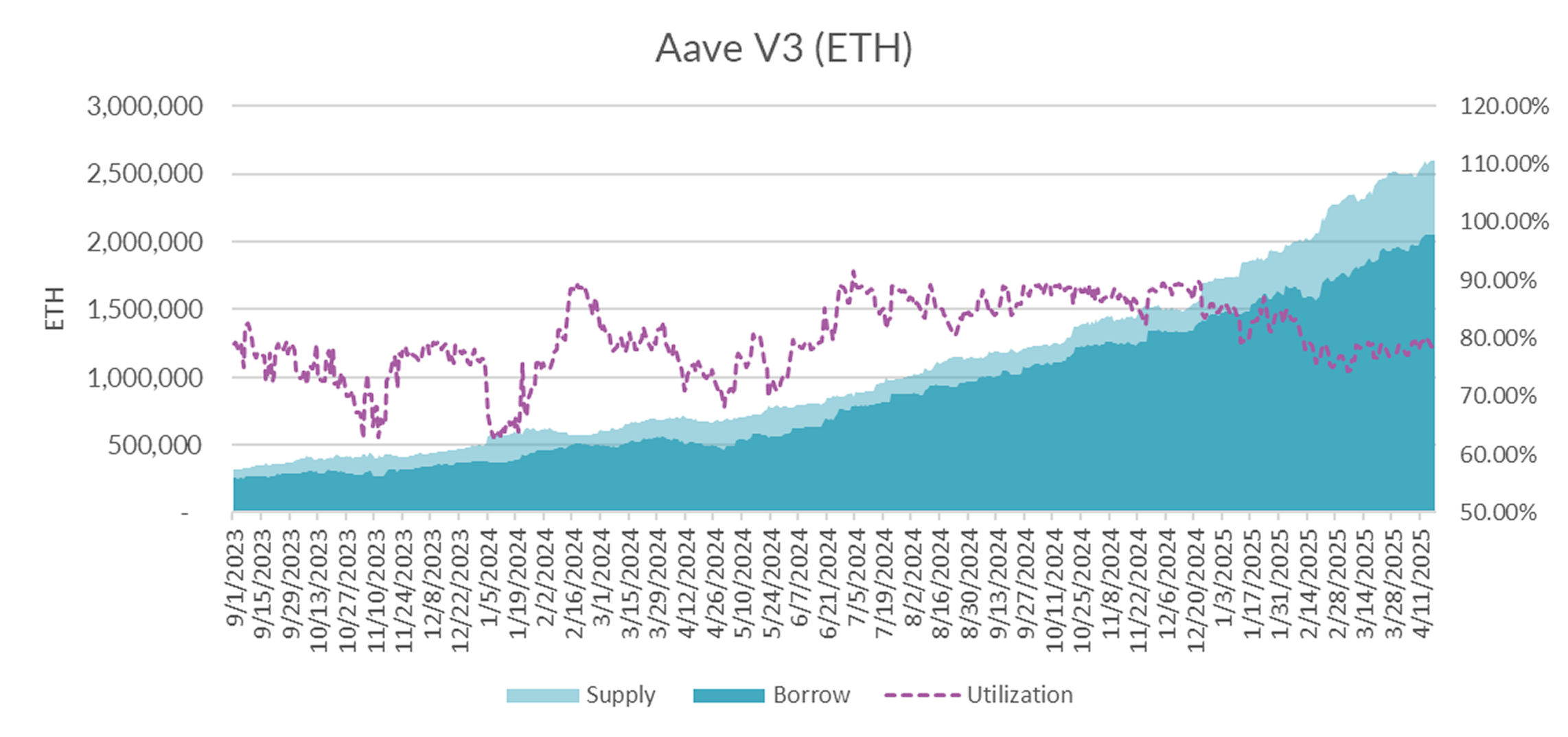

Turning now to ETH markets, ETH rates reverse course, falling by -4bp on the week to 2.84% on a 30-day trailing basis. The CESR staking index, on the other hand, held steady rising by just +1bp to 3.05%, causing the spread to widen by roughly +5bps on a 30-day trailing basis.

Market internals show that new supply (+52k ETH) outstripped demand (+28k ETH) week on week.

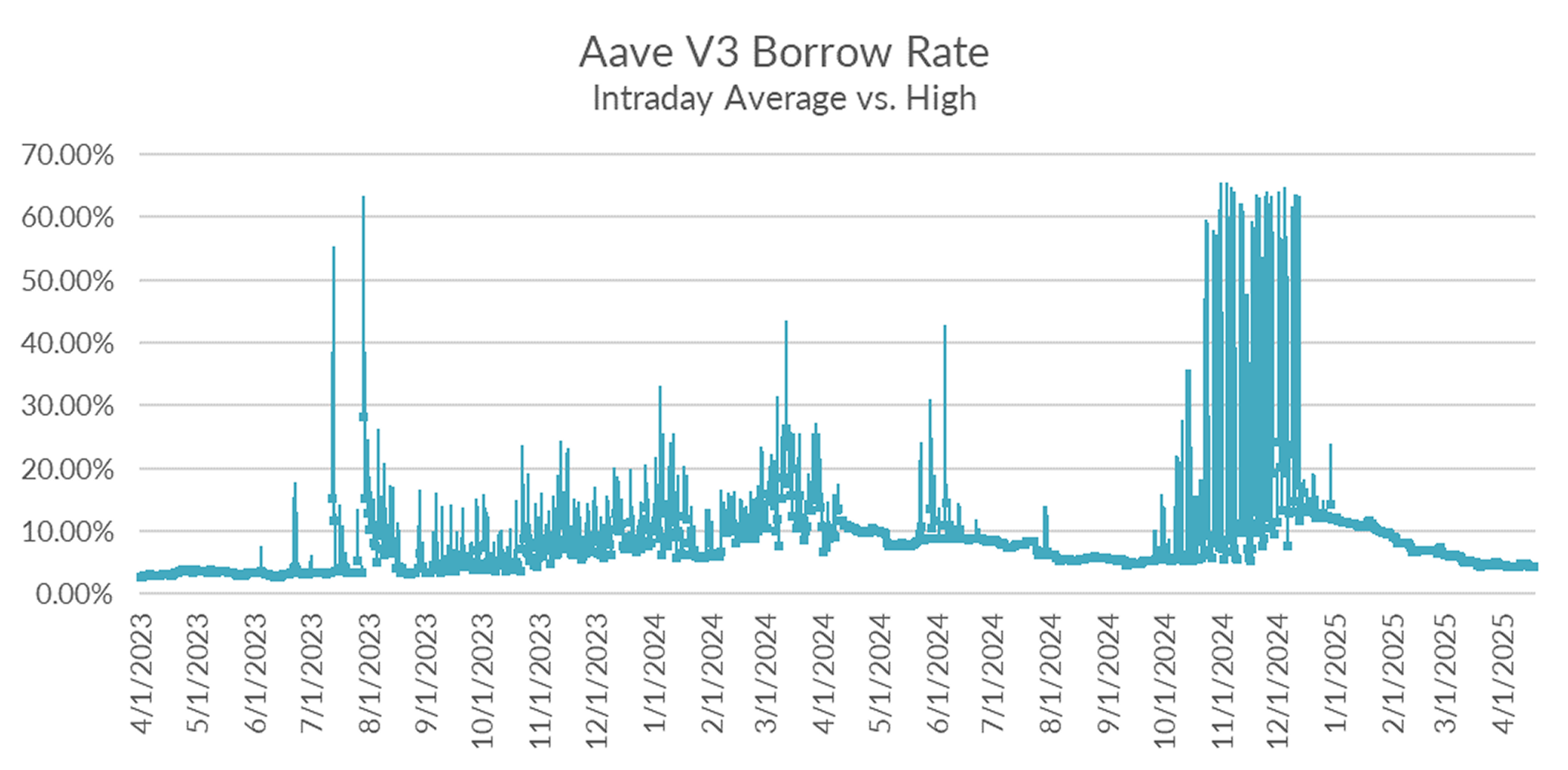

And despite the week on week decline in ETH borrow rates, this glosses over the fact that significant intraday volatility remains - specifically last Sunday saw ETH borrow rates rise as high as 14.6% for a brief period of time.

While the macro market position remains balanced and robust, intraday volatility suggest that brief spikes in demand continue to trouble ETH markets on Aave. In the near term, risk remains to the upside.

Week-on-week, crypto asset markets were flat to slightly up, consistent with global equity markets and DeFi/perpetual funding rates. The market is now awaiting the outcomes of ongoing tariff negotiations and the détente between the U.S. and China in their bilateral trade war for its next move. Recent remarks from Trump suggest a de-escalation in the standoff—a promising sign, though not one to bank on.