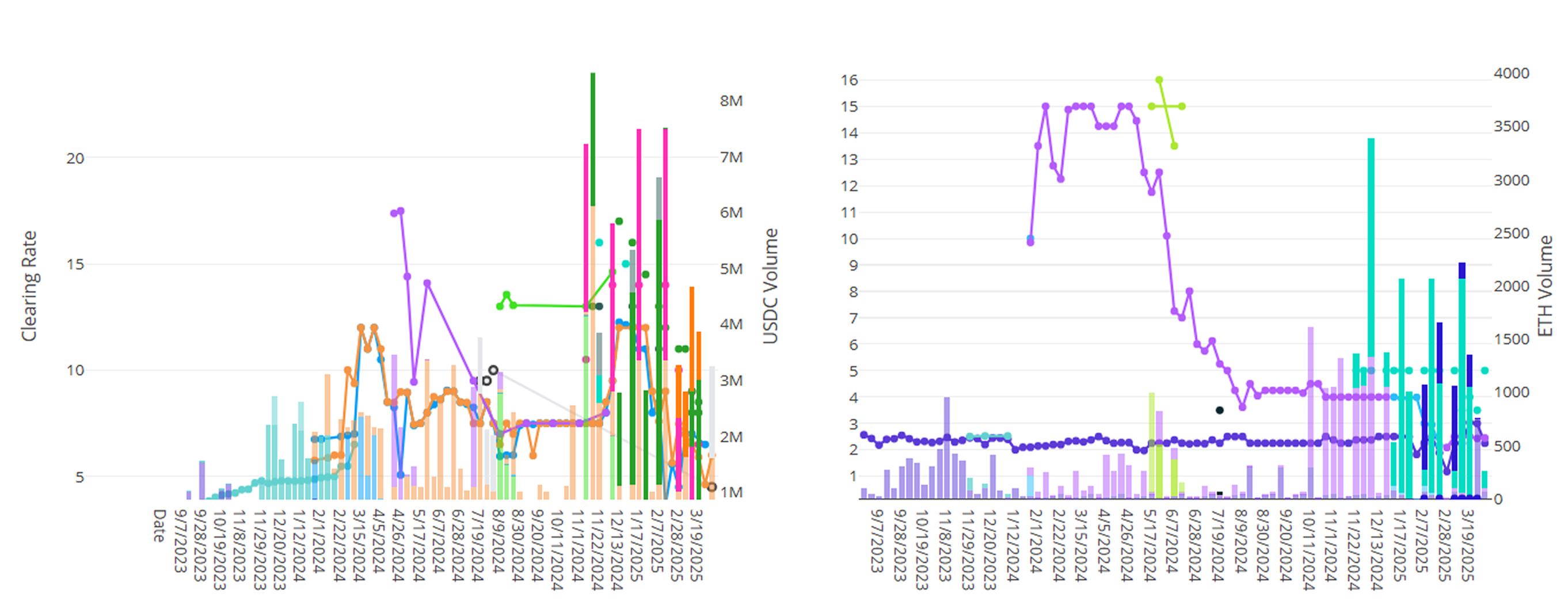

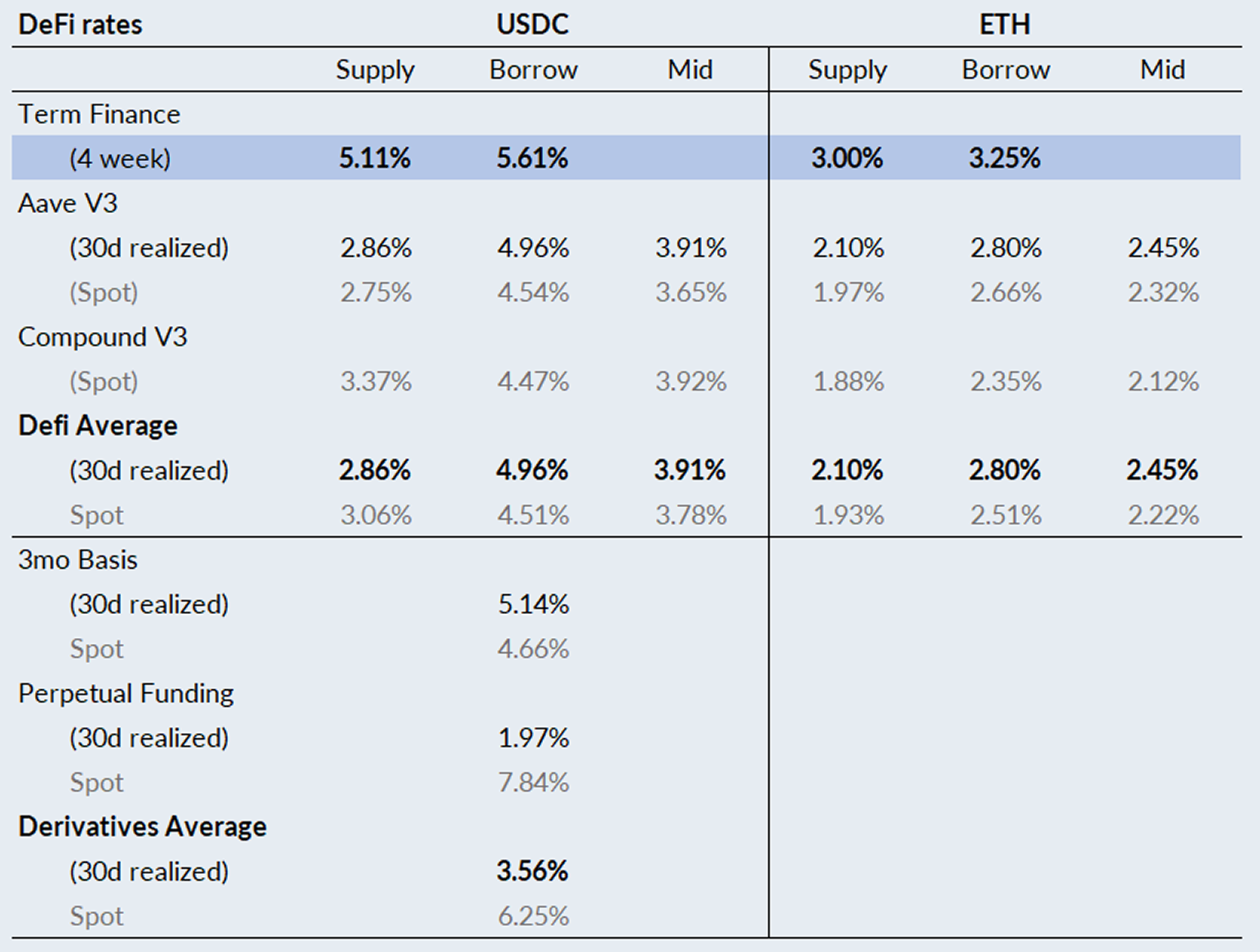

Clearing rates held steady this week on Term, averaging around 4.5–6% against the majors for USDC and 2.25–2.5% for ETH. Overall, fixed rates on Term continue to offer a solid premium compared to their variable-rate lending counterparts, whose lenders are diluted during periods of underutilization.

For those eager to lock in fixed rates and hedge against further declines in lending rates, visit our Blue Sheets Simple Earn page to explore current opportunities (Not available to U.S. persons).

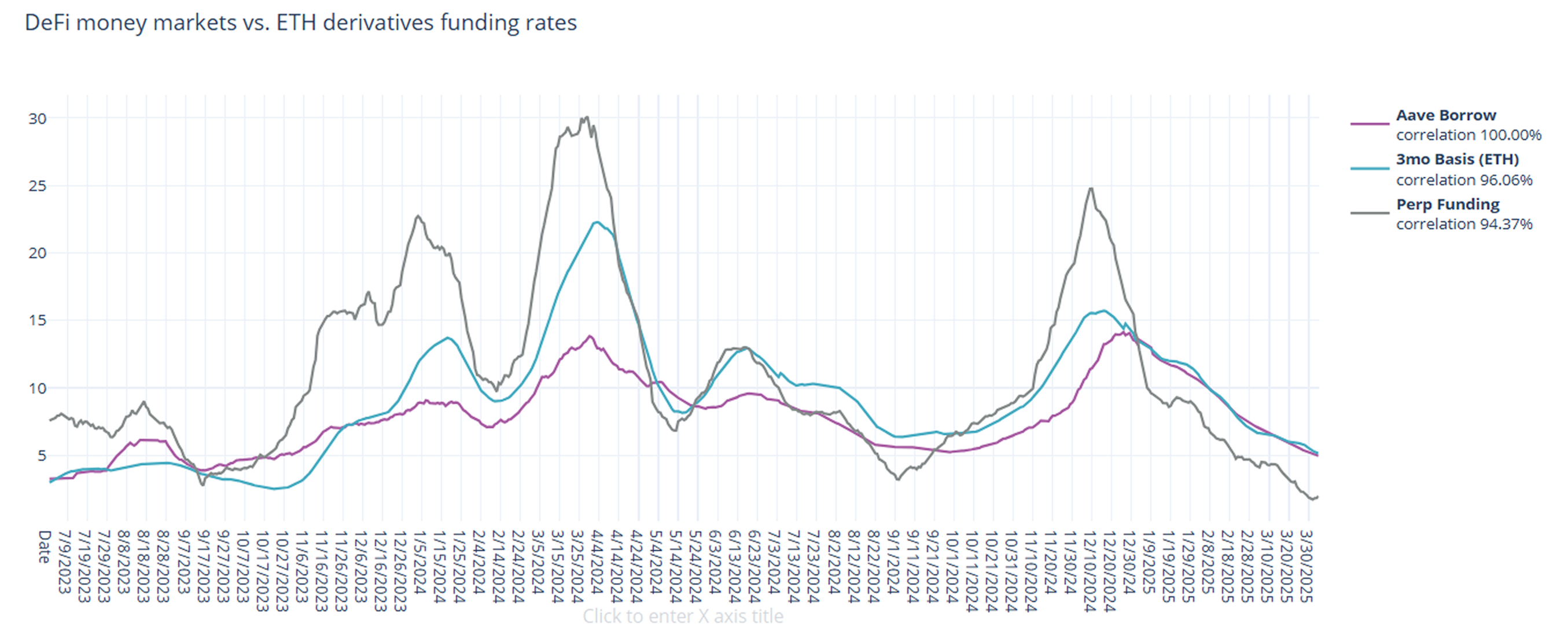

In derivatives markets, funding rates continue to decline, with 3-month basis falling by -61bps to 5.14% and perpetual funding rates falling by -23bps to 1.97% on a 30-day trailing basis.

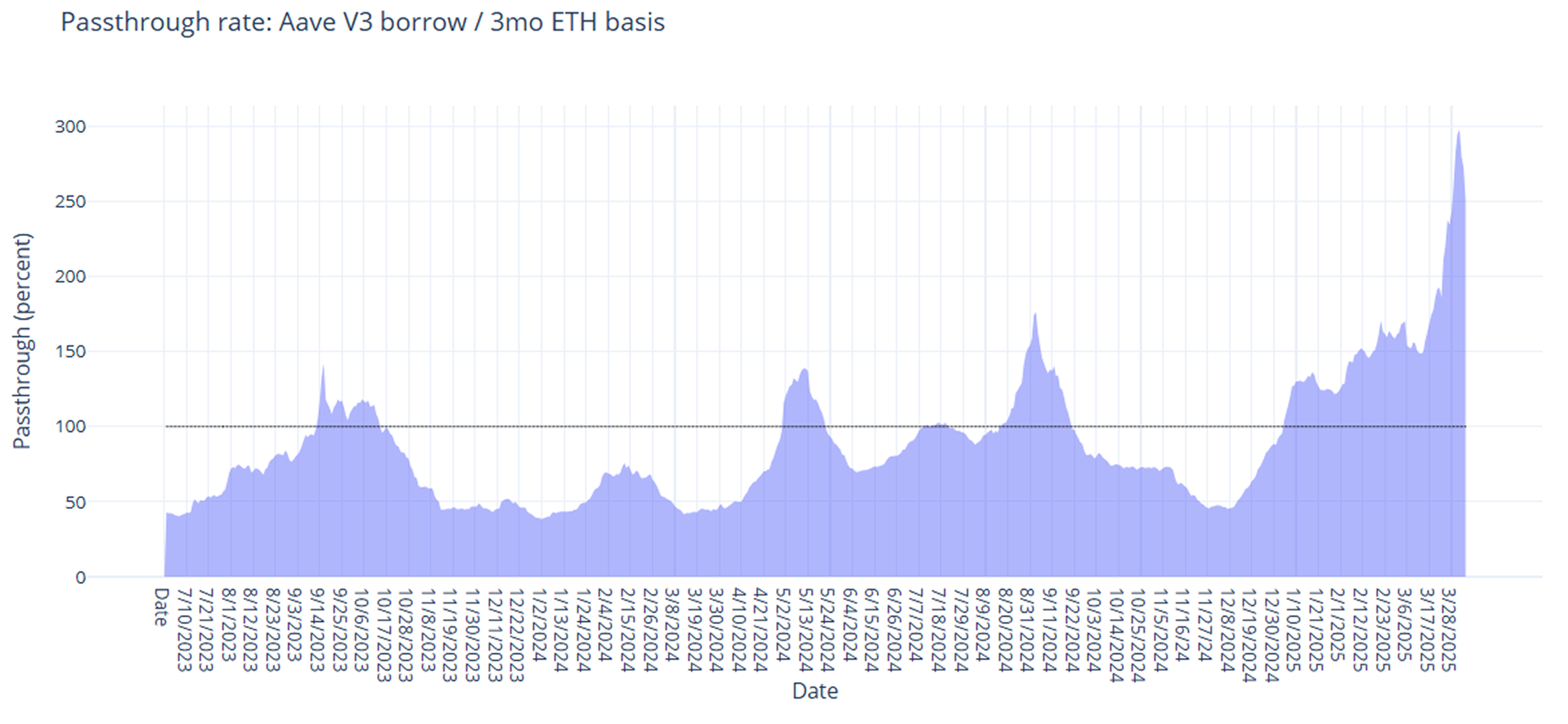

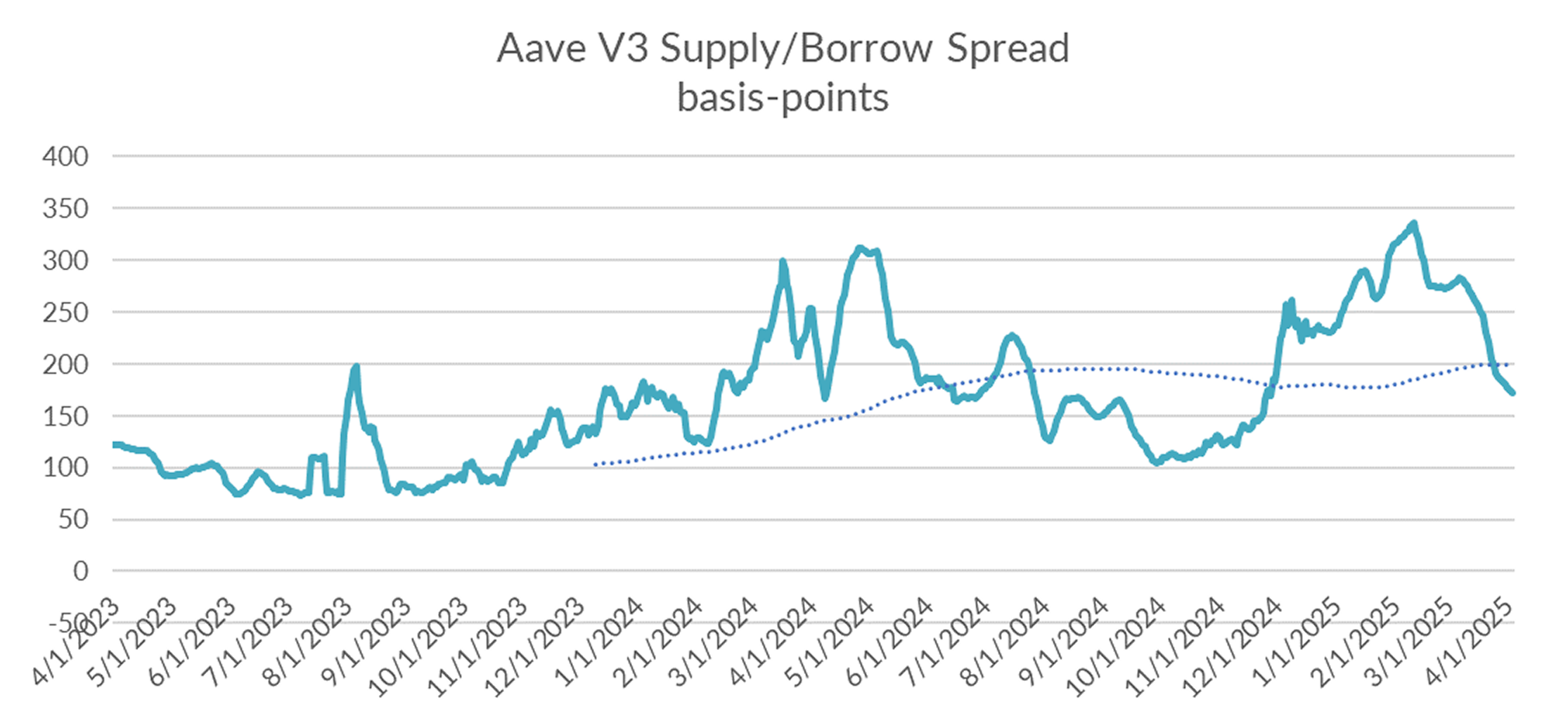

DeFi protocols, on the other hand, hold steady, keeping the spread between DeFi rates and derivative rates at historical wides.

With no meaningful signs of change in this downtrend, expect derivatives rate to remain suppressed in the near term.

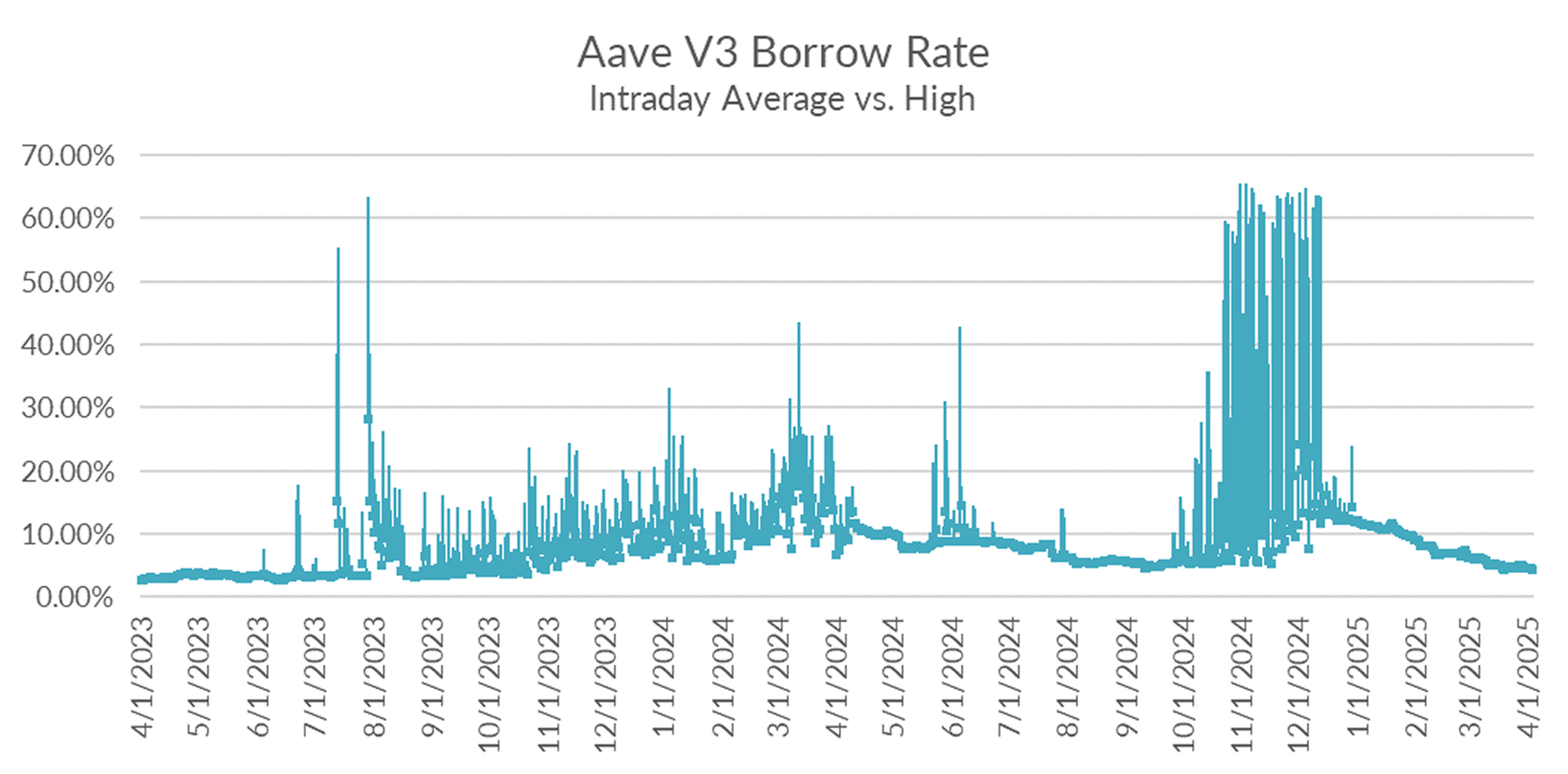

Turning to DeFi variable rate markets, the 30-day trailing average declined another -37bps on the week to 4.96%. Over a shorter lookback period (just seven days), Aave borrow rates averaged 4.65% on the week, foreshadowing continued weakness ahead.

Diving in the microstructure of Aave USDC markets, utilization declined from 68% down to 63% as of the time of writing, due primarily to the repayment of over 111M in USDC loans.

While markets feel particularly depressed with the cloud of an escalating trade war in the background, the length of this period of suppressed yields is not particularly extraordinary.

Indeed, the market saw an extended period of low yields last year that remained subdued for the majority of Q2 and Q3 of 2024.

With yields suppressed and utilization oscillating in the mid 60s, expect rates to remain steady or grind lower in the near term.

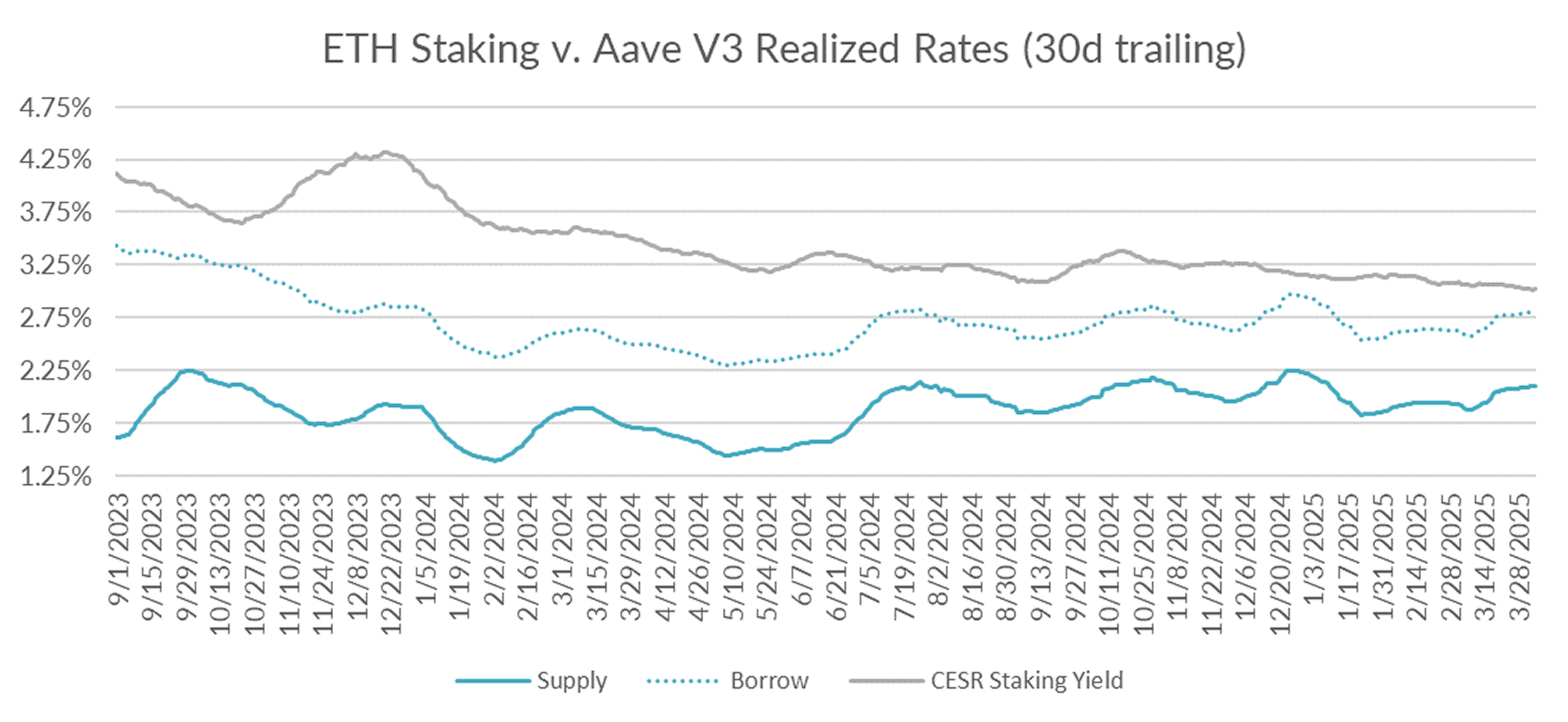

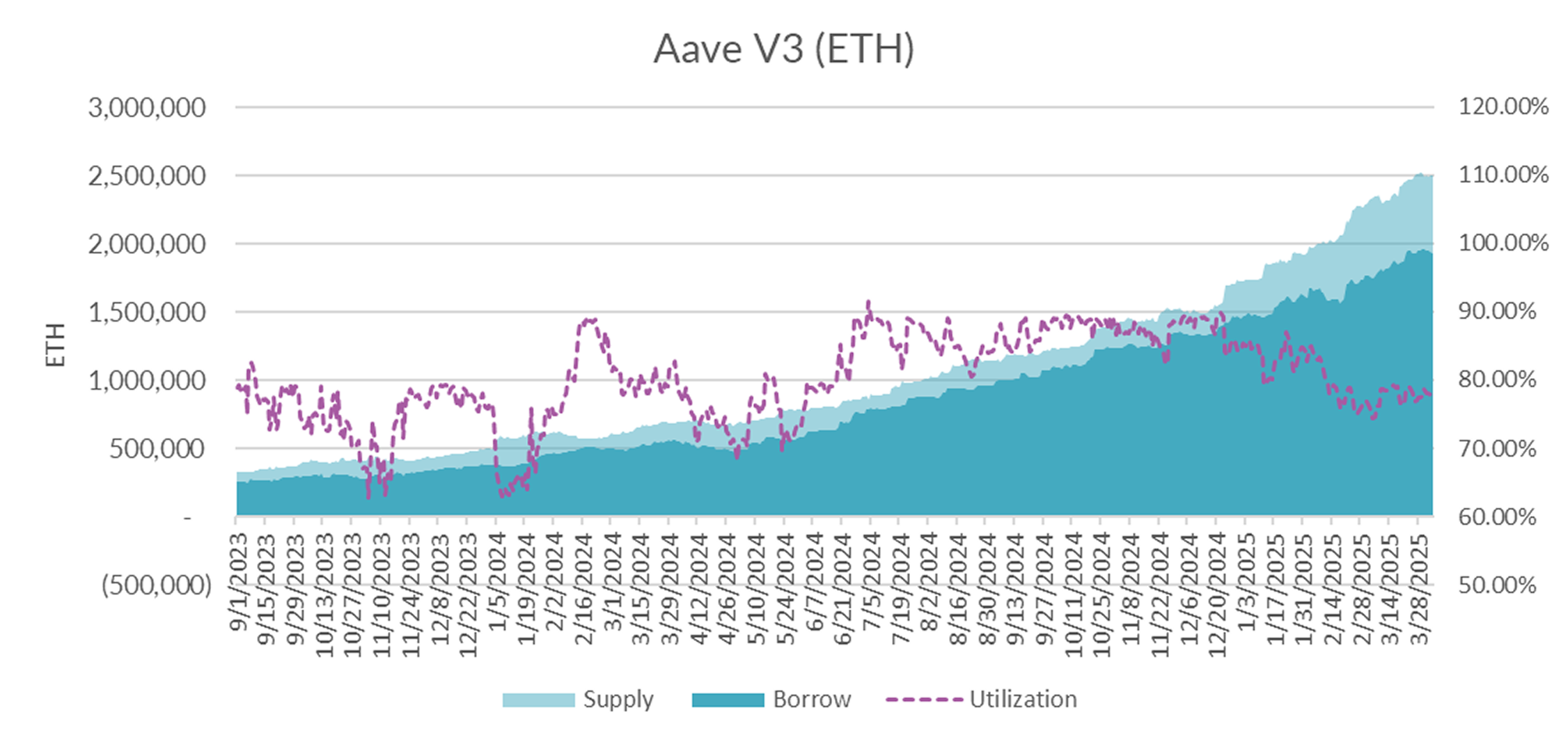

Turning now to ETH markets, ETH rates continue to grind higher, rising by +2bp on the week to 2.80% on a 30-day trailing basis. The CESR index, on the other hand, fell by -2bp causing the spread between staking and borrowing rates to narrow by a full -4bps on a 30-day trailing basis.

Market internals show that the overall supply and demand picture has been relatively stable on Aave. Of particular note this week is the first decline in ETH supply in over a month.

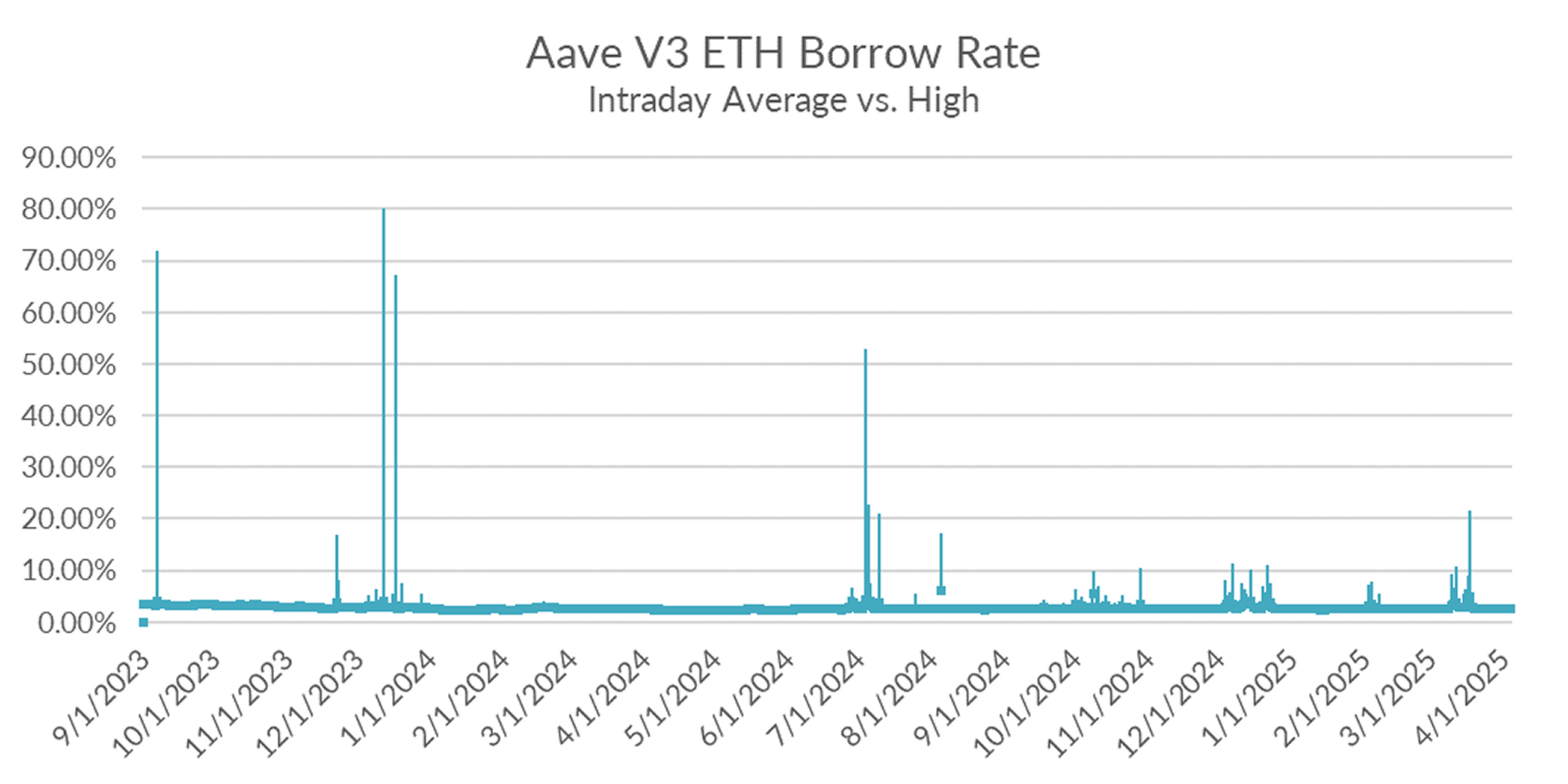

Despite this modest decline in ETH supply of -11k ETH, intraday rates show no signs of stress due to overutilization.

With ETH borrow rates beginning to push up against the ETH staking index, it would be natural to expect rates to begin to top out in the near term.

The news of the week was undoubtedly Trump’s Liberation Day that introduced across the board tariffs of 10% with specific countries carrying large trade imbalances with the US singled out for tariff hikes in excess of 30-40%. Markets did not respond kindly to this announcement. The S&P 500 saw two consecutive days of declines of around -5%, the largest since June 2020. Despite this turmoil in traditional equity markets, there are signs that crypto assets are beginning to decouple from broader equity markets. Week on week, the S&P500 closes down -7.5% while BTC closes unchanged. The silver lining in this tectonic shift to the global trade order is that crypto assets may be beginning to turn the corner. Indeed increased odds of rate hikes in the second half of this year doesn’t hurt this thesis.