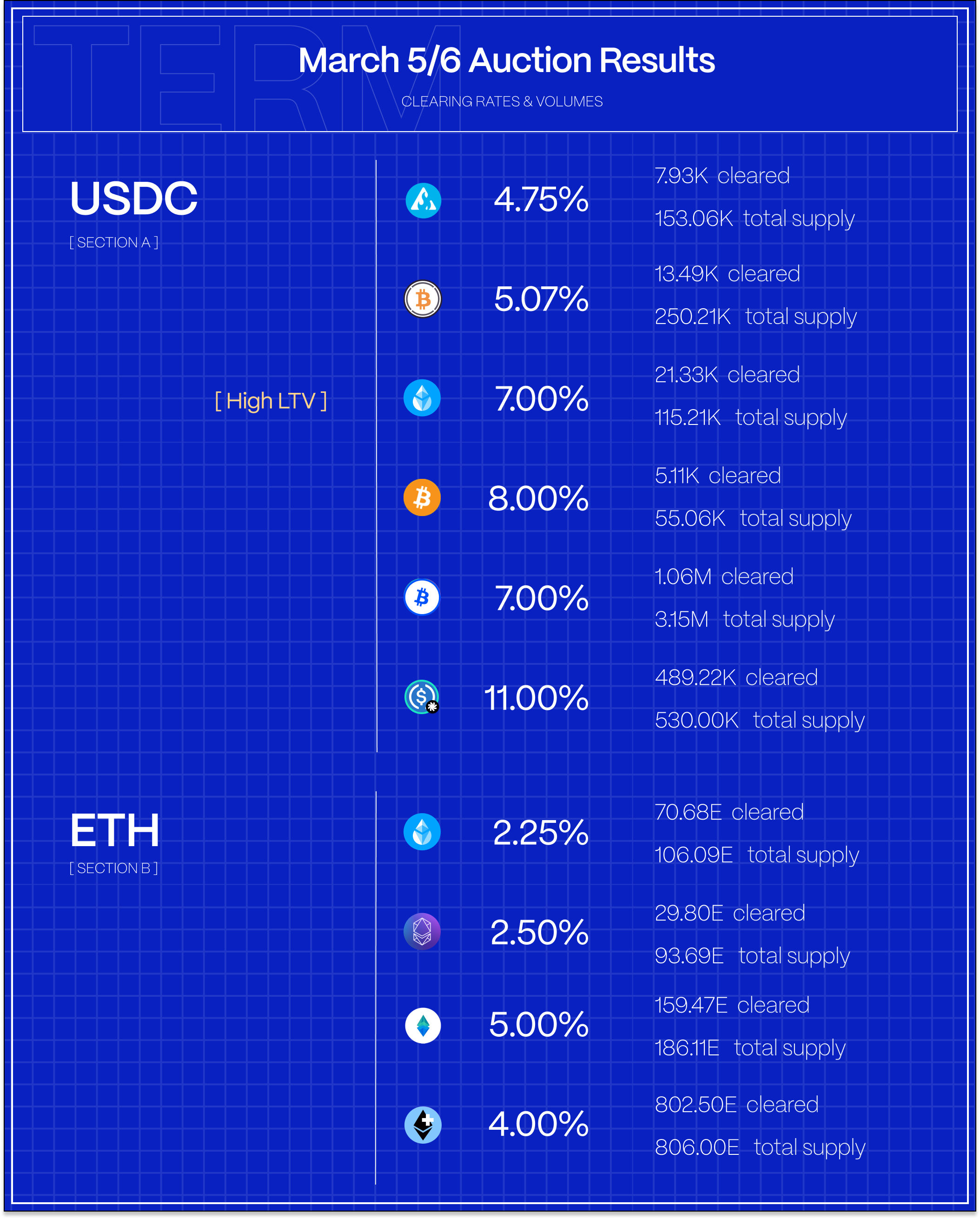

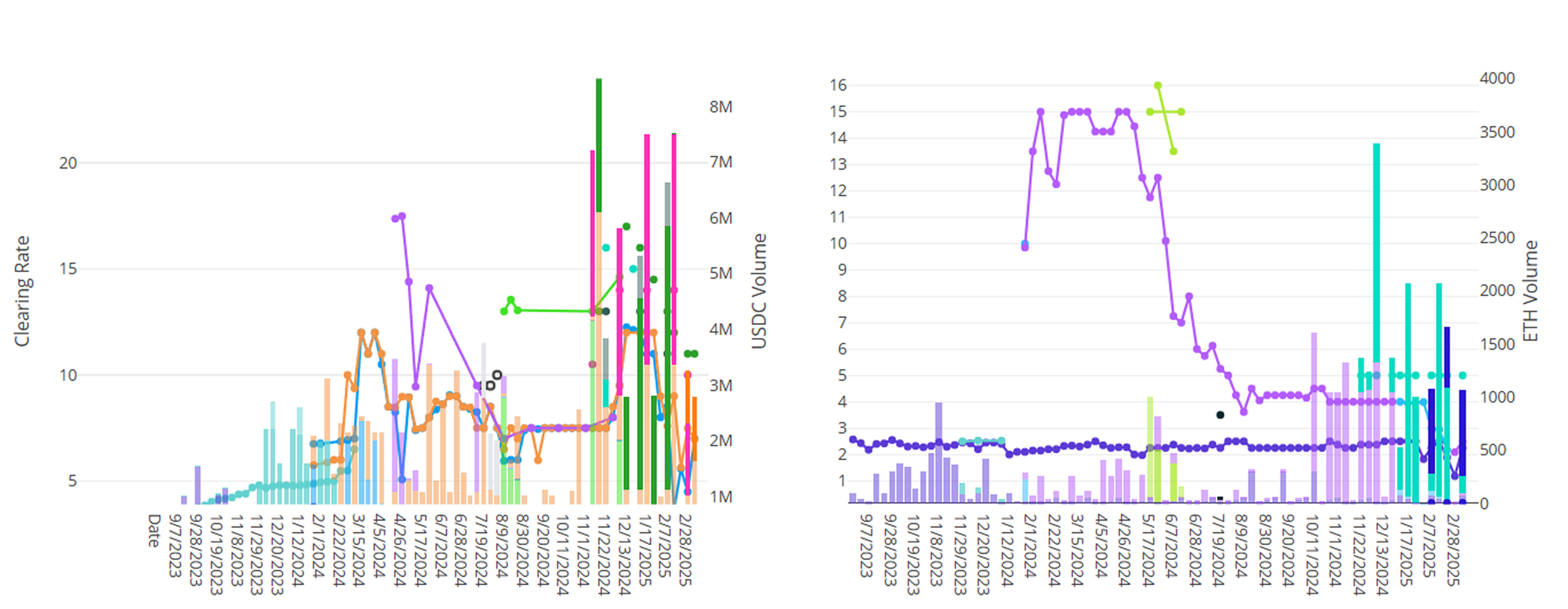

Stablecoin volumes dipped this week as declining PT yields triggered deleveraging amongst DeFi yield farmers. Stablecoin demand against the majors (wstETH and wBTC/cbBTC), however, remain robust and increased some week on week. In ETH markets, rates and demand remain stable.

For those eager to lock in fixed rates and hedge against further declines in lending rates, visit our Blue Sheets Simple Earn page to explore current opportunities (Not available to U.S. persons).

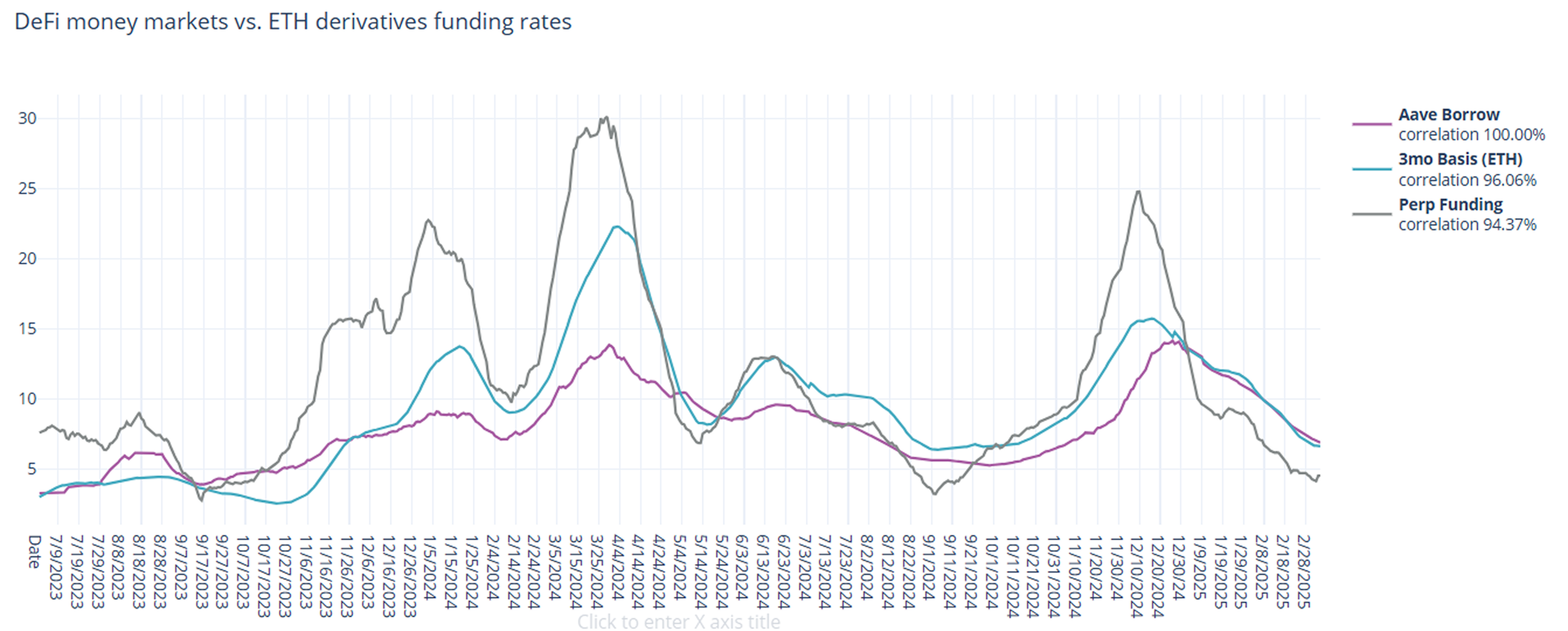

In derivatives markets, funding rates continue to decline, albeit at a slower rate, with 3-month basis falling by -41bps to 6.61% and perpetual funding rates falling by -20bps to 4.49% on a 30-day trailing basis.

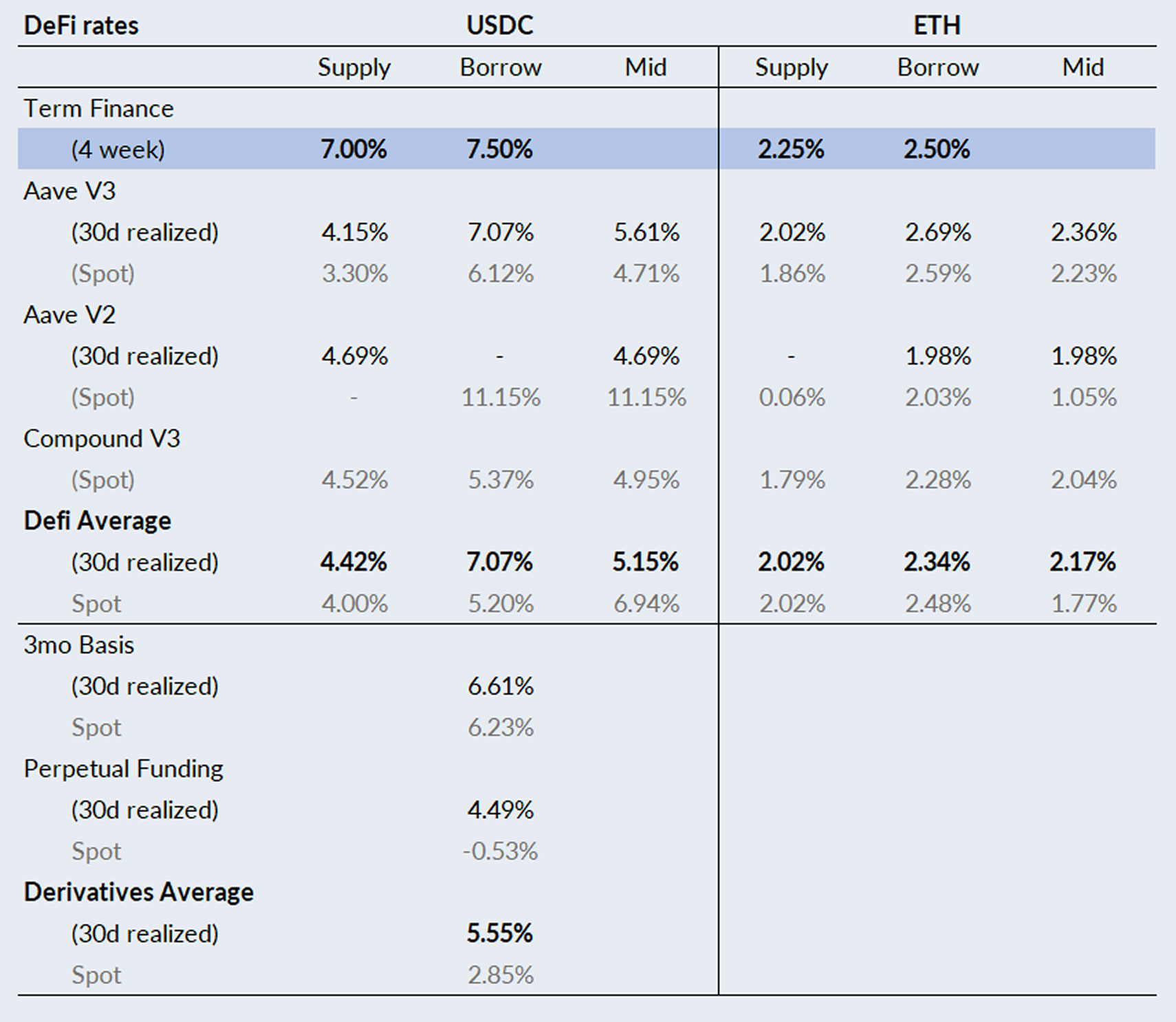

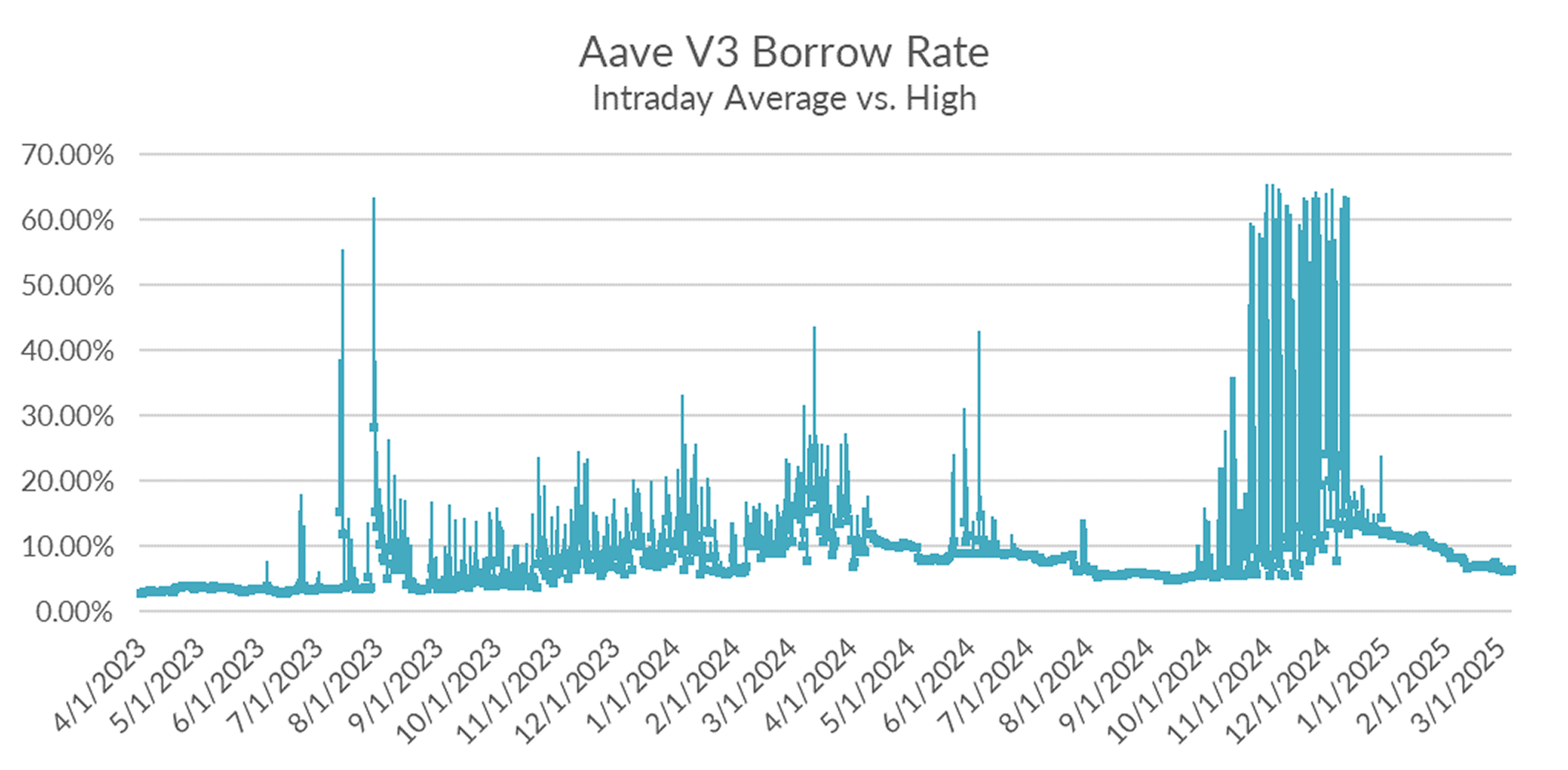

With floating rate protocols behind the curve on adjusting rates, DeFi borrow rates continue to remain elevated as compared to derivatives funding rates, hovering at extremes not seen since late last summer.

With intense market uncertainty surrounding tariffs and heightened volatility in cryptoasset markets, expect markets to continue to avoid leverage and perp rates to remain subdued.

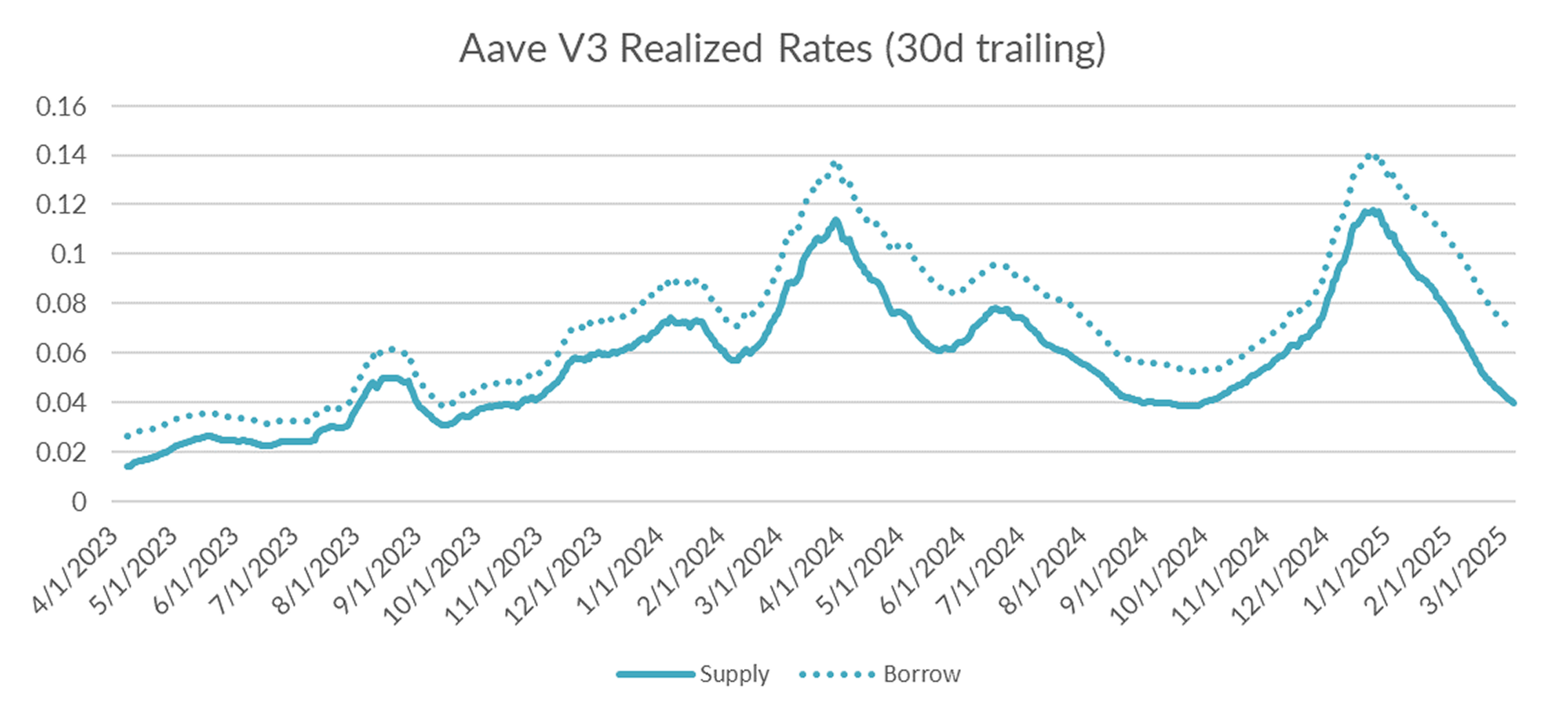

Turning to DeFi variable rate markets, floating rates continue to decline, closing down -57bps on the week to 6.86% on a 30-day trailing basis. Over a shorter lookback period (just seven days), Aave borrow rates averaged 6.43% on the week, foreshadowing further declines ahead.

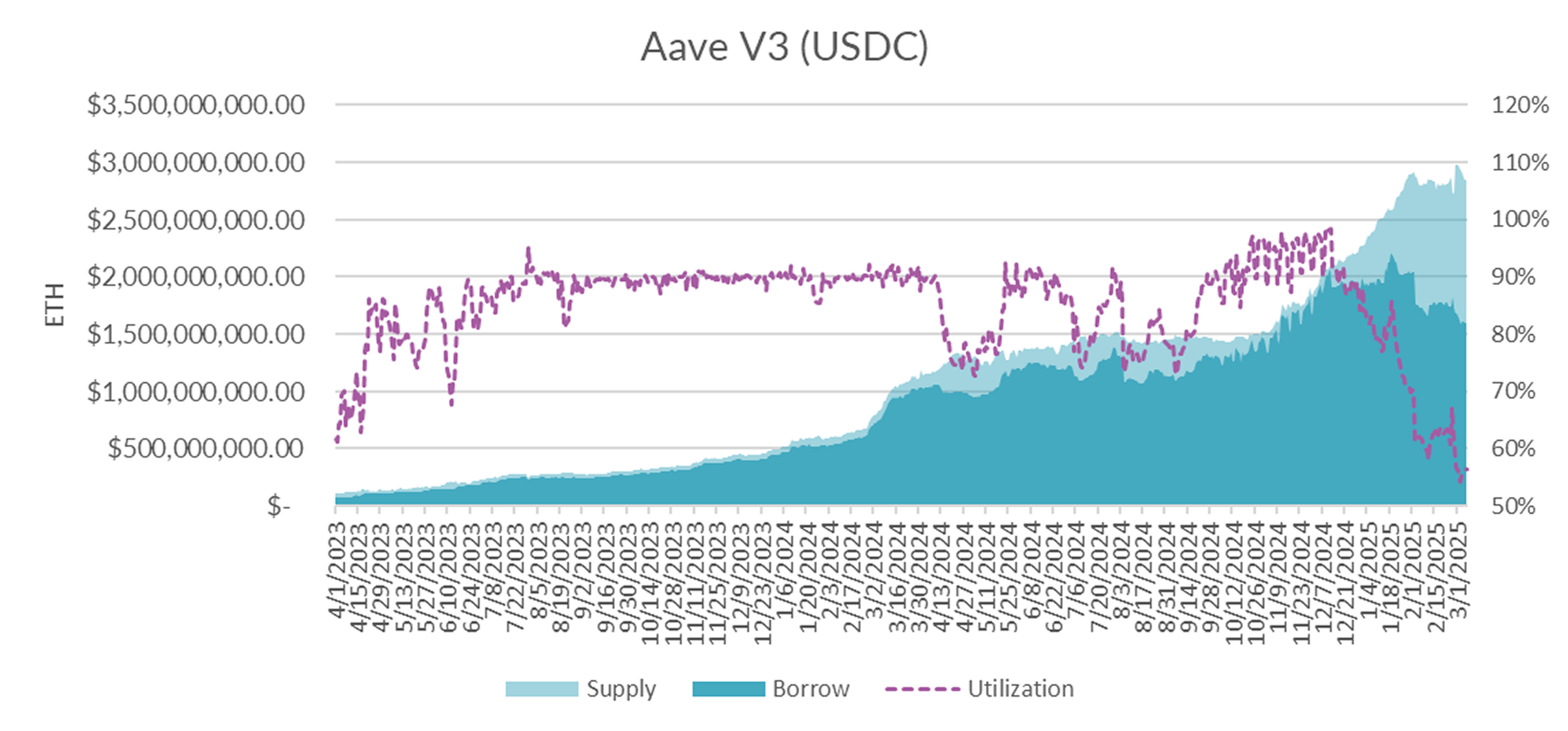

Diving in the microstructure of Aave USDC markets, utilization took another leg down to just 56% utilization, a multi-year low.

What is most surprising about the market internals is perhaps that USDC supply levels remain at all time highs, despite significantly deteriorating supply rates that now yield less than Fed Funds.

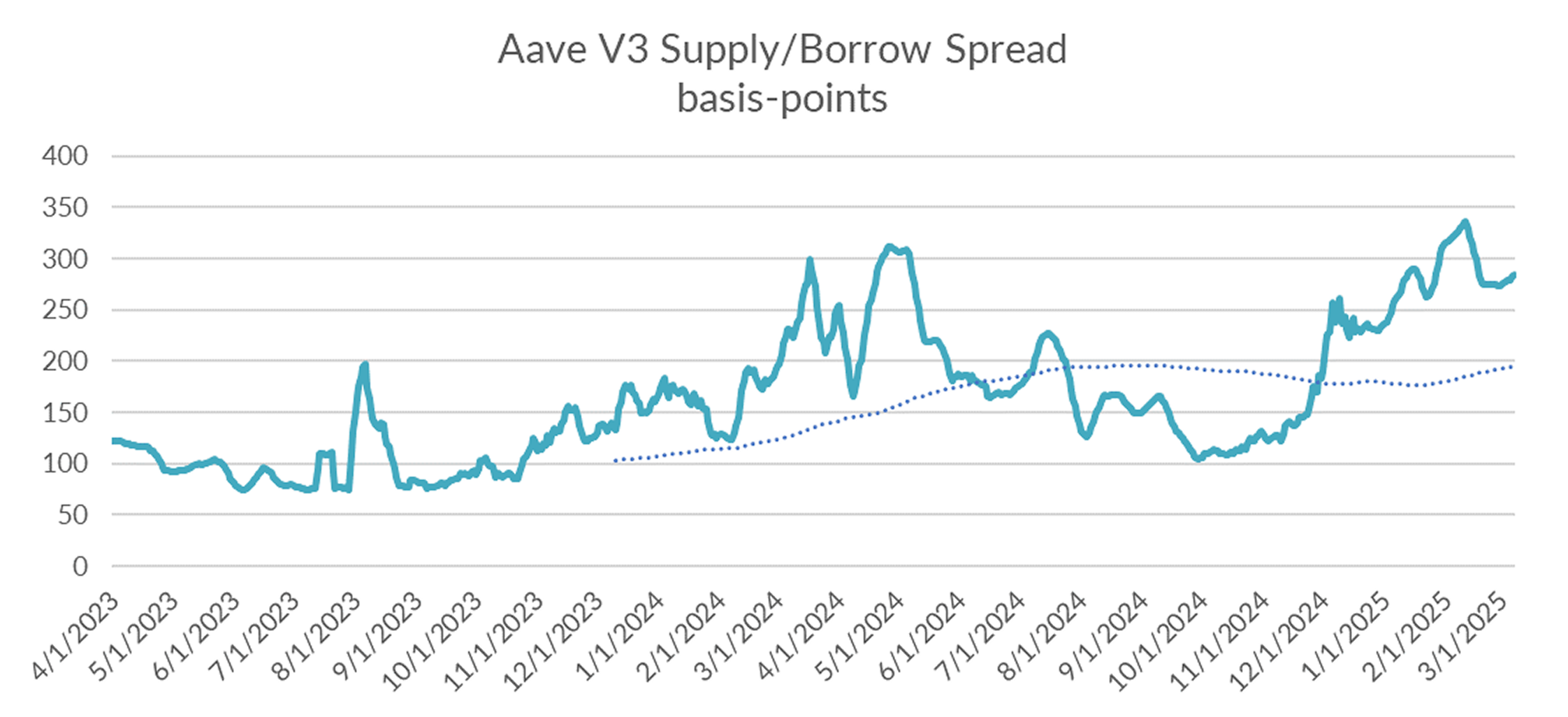

As a result of all this unutilized supply, the spread between borrow and supply rates on Aave remain at cycle highs of 300bps+ despite borrow rates in the mid single-digits.

Unless the market turns soon, Aave may have to make another adjustment in the not too distant future.

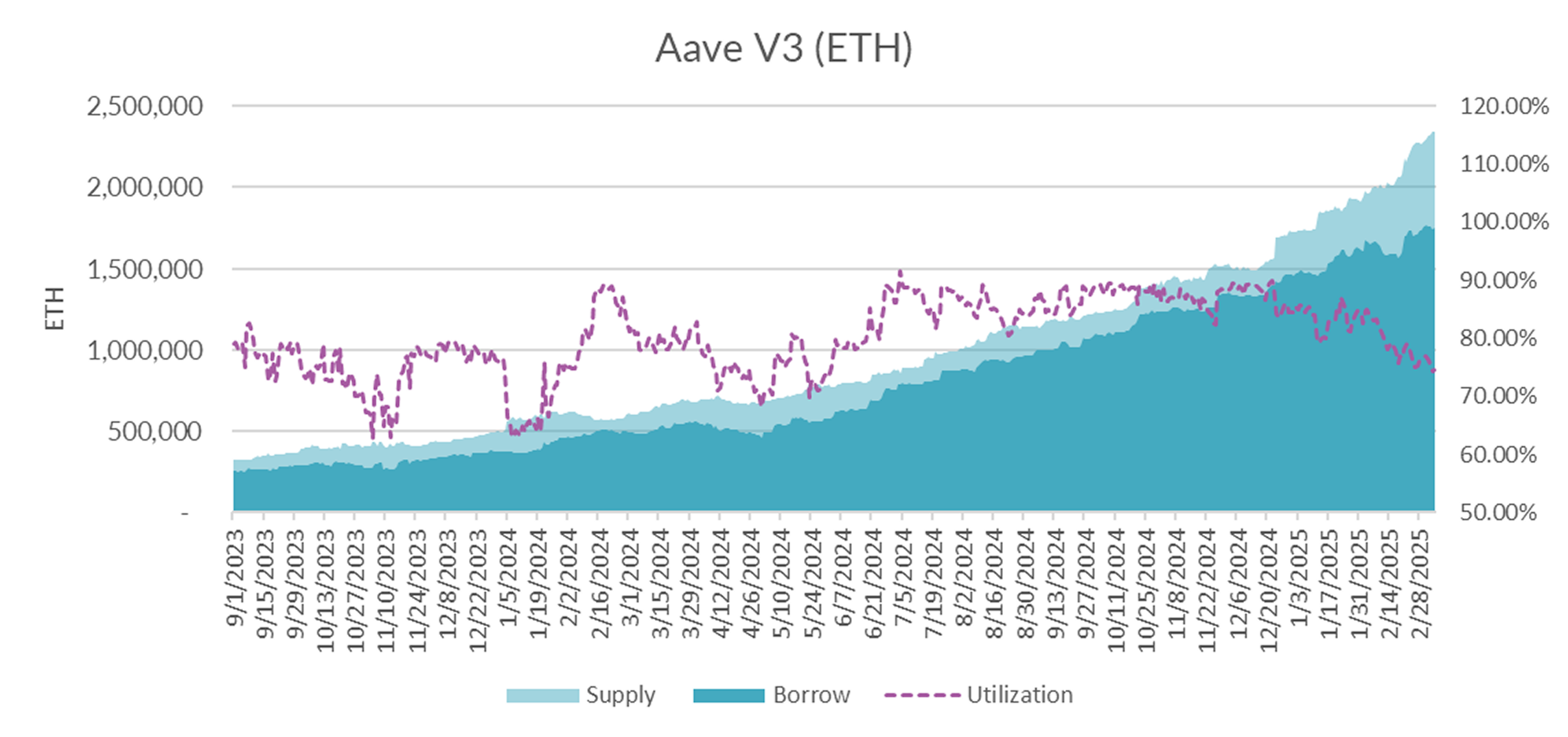

Turning now to ETH markets, ETH rates close down -5bps on the week to 2.57% on a 30-day trailing basis. The CESR index similarly declined by -2bps this week, widening the spread between staking and borrowing to 48bps on a 30-day trailing basis.

Market internals show that ETH supply continues to outpace demand, which remains relatively stable over the past couple of weeks.

Overall, intraday volatility has settled back down to stable state due to declining utilization.

Overall, while not nearly as stark as seen in USDC markets, utilization also continues to drop each week and closes just under 75%, resulting in a 71bp spread between borrow and lend rates.

Higher consumer prices via the tariff channel, and lower GDP due to sharp government spending cuts all point to a period of austerity and slower growth ahead. The upshot of all this is that this gives the Fed cover to lower interest rates in the medium term. With higher prices and potential monetary easing on the horizon, pure inflation hedges like Gold trade at all time highs while BTC, when looking at longer term charts, continue to trade well above the previous cycle peak and not far off all time highs. Despite this performance, heighted market uncertainty due to the risk of trade wars will keep traders honest and prevent them from taking on excessive leverage. This means DeFi lending rates are likely to remain subdued as well.